Frequently asked questions (FAQs): NYS-45 Upload

Check out our FAQs for answers to common questions about filing with NYS-45 Upload. For additional resources, also see Resources for withholding tax filers and Publication 72.5, Electronic Reporting of Form NYS-45 Information.

For payroll service providers

How do I report a foreign address?

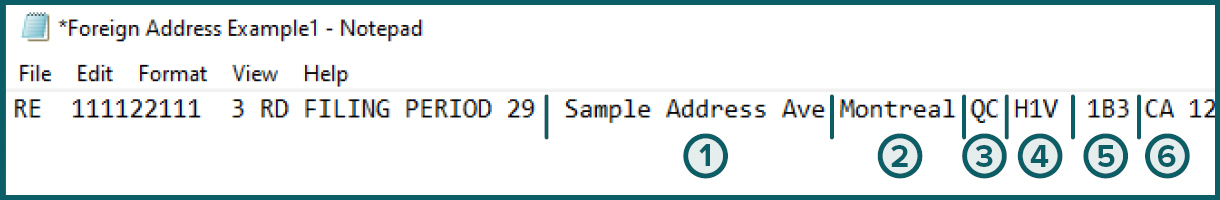

Foreign address example 1. From left to right, format is as follows:

- RE

- 111122111

- 3

- RD

- Filing period 29

- Sample Address Ave (with a number 1 next to it, which correlates to explanation 1 below the image)

- Montreal (with a number 2 next to it, which correlates to explanation 2 below the image)

- QC (with a number 3 next to it, which correlates to explanation 3 below the image)

- H1V (with a number 4 next to it, which correlates to explanation 4 below the image)

- 1B3 (with a number 5 next to it, which correlates to explanation 5 below the image)

- CA (with a number 6 next to it, which correlates to explanation 6 below the image)

- 12

- Positions 119–140: Enter the delivery address, which must include at least four alphanumeric characters.

- Positions 141–162: Enter the city, which must include at least three alphanumeric characters.

- Positions 163–164: Enter the state or providence. Use Federal Information Processing Standard (FIPS) postal abbreviations. In this example, the FIPS abbreviation is QC for Quebec, Canada.

If the country code is CA for Canada or US for United States, you must complete this field. - Positions 165–169: Enter the ZIP code. If the country code is US for United States or CA for Canada, you cannot enter all zeroes for the ZIP code.

If the country code is US, you must enter a ZIP code containing exactly five numeric characters with no spaces, commas, or hyphens between characters.

If the country code is CA, you must enter the ZIP code in the following format with no spaces, commas, or hyphens between characters: Alpha, Numeric, Alpha. In this example, the ZIP code is H1V. - Positions 170–173: Enter the ZIP code extension.

If the country code is CA for Canada, you must enter the ZIP code extension in the following format with no spaces, commas, or hyphens between characters: Numeric, Alpha, Numeric. In this example, the ZIP code extension is 1B3. - Positions 217–218: Enter the country code. For a listing of country codes, visit IRS: Country codes.

How do I report an Unemployment Insurance (UI) benefit reimbursement employer?

All reimbursable employers have an Employer Registration number from the Department of Labor (DOL) that begins with 04. If this is the case, you must report values on the return in the Number of employees and Total remuneration fields. For all other UI fields, enter zero.

Which fields do I report as whole dollar amounts?

Report amounts for the following fields as whole dollars (without cents):

- Total remuneration paid this quarter

- Corrected amounts for total remuneration

- Difference for total remuneration

- Remuneration paid this quarter in excess of the UI wage base

- Corrected amounts for excess remuneration

- Difference for excess remuneration

- Wages subject to contributions

- Corrected amounts for wages subject to contributions

- Difference for wages subject to contributions

For more information, see Instructions for Form NYS-45 and Publication NYS-50, Employer’s Guide to Unemployment Insurance, Wage Reporting, and Withholding Tax.

Can I round UI remuneration reported on the individual employee wage record level (Record RS (36) – State employee record)?

You may:

- report dollars and cents, or

- round to whole dollars.

However, you must:

- be consistent for all employees, and

- round the sum of the employee remuneration fields reported in the RV – State Total Record.

Is the rounding validation applicable only to filing the return, or does it affect the tax payment?

The amount due on the return and the amount of the payment must match, so rounding is applicable to both the return and the payment.

What does the error message Record out of sequence mean?

Record out of sequence is a file level error. It means your RA, RE, RS, RV, or RZ records are out of order. Each return consists of an RE employer record, an RS record for each employee associated with that RE record, and an RV record. At the file level, you must put the RA record first and the RZ record last. For example, to format a file with two returns, one with three employees and one with two employees, use the following format:

RA – Transmitter

RE – Employer A

RS – Employee 1

RS – Employee 2

RS – Employee 3

RV – State Total (for Employer A)

RE – Employer B

RS – Employee 4

RS – Employee 5

RV – State Total (for Employer B)

RZ – Final Record

How do I calculate and report the Total remuneration paid this quarter, UI contributions due, and Re-employment service fund?

- Add the wage-level UI remuneration paid amounts to get the Total remuneration paid. Round this total amount to the nearest whole dollar.

- Subtract Remuneration paid this quarter in excess of the UI wage base (rounded to the nearest whole dollar) from the Total remuneration paid to get Wages subject to contribution.

- Multiply the UI rate by the Wages subject to contribution, then round to two places after the decimal point for the final UI contributions due amount. Do not include the decimal point when reporting this value in your file.

- Multiply the re-employment service fund rate by the Wages subject to contribution, then round to two places after the decimal point for the final Re-employment service fund amount. Do not include the decimal point when reporting this value in your file.

Example:

- Your return includes three wage records with UI remuneration paid amounts of $14,111.24; $16,731.98; and $27,965.79. After rounding, the Total remuneration paid is $58,809.

- The amount paid in excess since January 1 is $36,727. The Total remuneration paid ($58,809) minus the amount paid in excess ($36,727) equals $22,082. This is the value for Wages subject to contribution.

- To determine UI contributions due, multiply $22,082 by 2.825%. Round the resulting 623.8165 to $623.82.

- To determine the Re-employment service fund, multiply $22,082 x 0.00075. Round the resulting 16.5615 to $16.56.

I filed an amended return. Does the total amount due shown on my return need to match my payment amount?

Your check amount must match the total amount due shown on your amended return. If one client overpaid and another underpaid, you must pay the total amount due. We will refund the client who overpaid. Do not reduce payment owed by any overpayments within the file. This is the same for an original return.