Inflation refund checks

The 2025–2026 New York State budget provides for the state’s first-ever inflation refund checks. These one-time payments provide relief to New Yorkers who have paid increased sales taxes due to inflation. If you qualify for a payment, you do not need to do anything; we will automatically send you a check. Checks will be mailed over a period of several weeks starting at the end of September 2025.

Am I eligible?

You are eligible for a refund check if, for tax year 2023, you:

- filed Form IT-201, New York State Resident Income Tax Return;

- reported income within the qualifying thresholds below; and

- were not claimed as a dependent on another taxpayer’s return.

How much of a refund will I receive?

The amount of your refund check depends on your income and filing status for the 2023 tax year:

| Filing status | 2023 New York Adjusted Gross Income (Form IT-201 line 33) | Refund amount |

|---|---|---|

| Single | $75,000 or less | $200 |

| more than $75,000, but not more than $150,000 | $150 | |

| Married filing joint | $150,000 or less | $400 |

| more than $150,000, but not more than $300,000 | $300 | |

| Married filing separate | $75,000 or less | $200 |

| more than $75,000, but not more than $150,000 | $150 | |

| Head of household | $75,000 or less | $200 |

| more than $75,000, but not more than $150,000 | $150 | |

| Qualifying surviving spouse | $150,000 or less | $400 |

| more than $150,000, but not more than $300,000 | $300 |

When will I get my check?

We began mailing refund checks to eligible taxpayers at the end of September 2025. Over 8 million New Yorkers will receive refunds, and this large volume of checks will be mailed over a multiple week period. You may receive your check sooner or later than your neighbors, as mailings are not based on zip code or region. We cannot provide a specific delivery schedule, and our Contact Center representatives will not have additional information on the status of your check.

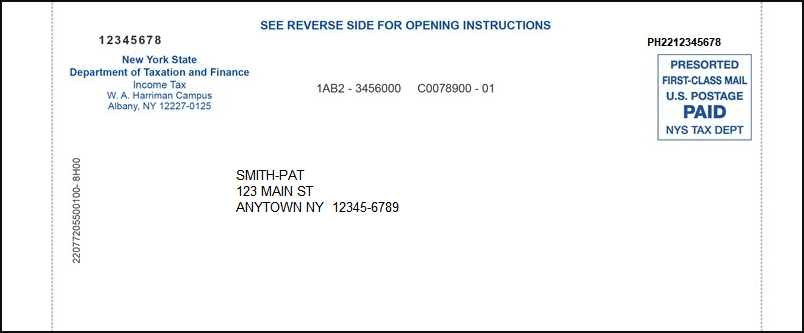

Watch your mailbox for a check that looks like this:

FAQs

Do I need to apply for the inflation refund check?

No. We will automatically send you a check if you meet the eligibility criteria.

Where will my inflation refund check be mailed?

Inflation refund checks will be mailed to the most current address that the Department has on file for you, usually the address from your most recently filed tax return. Although eligibility is based on your 2023 tax return, the Department will mail your check to the most recently updated address. For example, if you moved after you filed your 2023 return, but you filed your 2024 return with your new address, your check will be mailed to the address utilized on the more recent 2024 tax return.

Can I update my address with the department?

Yes. If your most recently filed return does not reflect your current address, or the address on file is different from your current address, you can update your address with the Department using your Individual Online Services Account. If you do not have an Online Services Account, see Create an Online Services Account.

I had my income tax refund automatically deposited in my bank account. Will my inflation refund check be automatically deposited as well?

No. If your income tax refund was directly deposited, you will still receive an inflation refund check. We started mailing checks at the end of September 2025.

I did not file a New York resident income tax return for 2023. Will I still receive a check?

No. The Department will determine eligibility for an inflation refund check based on the income reported on your income tax return. We will mail checks to taxpayers with a 2023 resident income tax return on file with the Department.

I was a part-year resident with New York source income in 2023. Will I receive a refund check?

No. You must have been a full-year New York resident to receive an inflation refund check.

My 2023 tax refund was applied to an outstanding debt. Will my inflation refund be applied to an outstanding debt?

No. The amount of your inflation refund will not be applied to any outstanding debts.