Distribution of Parcels by Property Class—2022 Assessment Rolls

The New York State Department of Taxation and Finance, Office of Real Property Tax Services (ORPTS) has developed a set of real property use codes which are used by assessors to describe the use of all parcels listed on assessment rolls. The ORPTS classification system is uniformly applied to all New York State municipalities. A description of each of the specific codes is provided as an appendix to this report.

Individual codes, which are three digits, are grouped into nine general categories, referred to as broad-use categories. Broad-use categories are composed of divisions, indicated by the second digit, and subdivisions (where necessary), indicated by a third digit.

The nine categories are:

| Broad-use category | Description |

|---|---|

| 100 | Agricultural |

| 200 | Residential |

| 300 | Vacant land |

| 400 | Commercial |

| 500 | Recreational and entertainment |

| 600 | Community services |

| 700 | Industrial |

| 800 | Public service |

| 900 | Wild, forested, conservation lands, and public parks |

This report shows the number of parcels contained within each of the 301 property classification codes which were valid for use on the 2022 assessment rolls. County-level parcel count summaries for each of the nine broad-use categories are provided in a separate table.

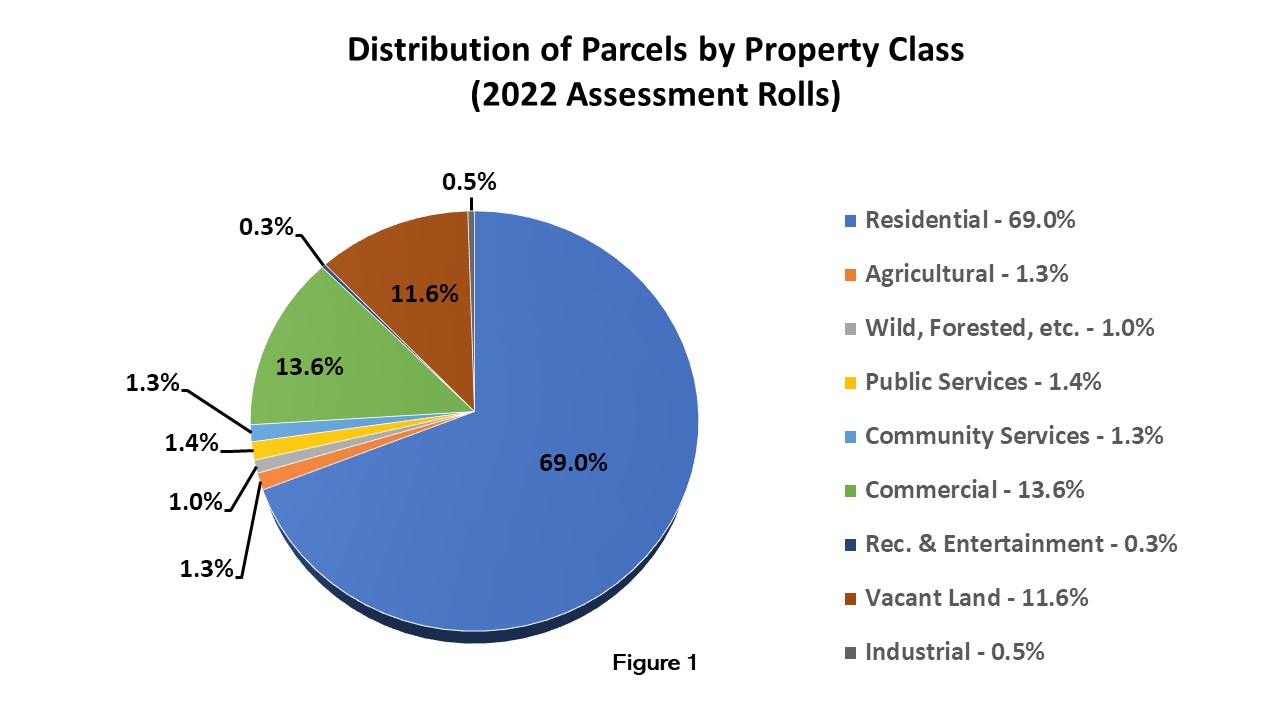

Figure 1 shows the relative shares for each of the nine broad-use categories. Around 69 percent of the parcels belong to the residential class. The next most populous category is commercial property, representing 13.6 percent of all parcels, followed by vacant land property at 11.6 percent. The remaining valid categories range from a low of 0.3 percent (recreation and entertainment) to a high of 1.3 percent (tie for agricultural/public service). Properties assigned invalid classification codes represent about 0.23 percent of all codes, indicating the high level of successful adoption the classification system has achieved.

Distribution of parcels by property class: Residential 69.0%; agricultural 1.3%; wild, forested, etc. 1%; public services 1.4%; community services 1.3%; commercial 13.6%; rec. and entertainment 0.3%; vacant land 11.6%; industrial 0.4%

Special classification for New York City and Nassau County

Two New York State assessing units, New York City and Nassau County, are governed by Article 18 of the Real Property Tax Law. This statute permits them to assess and tax four specified classes of real property differentially. These classes, and the incidence of parcels within each of them for the 2022 assessment rolls, are outlined below.

| Class | Property description | Number of parcels | |

|---|---|---|---|

| Nassau County | New York City | ||

| 1 | One, two and three-family residences, certain residential condominiums, and certain vacant land parcels |

387,592 | 707,117 |

| 2 | Residential property other than Class 1 | 6,583 | 307,406 |

| 3 | Public utility property | 2,373 | 4,874 |

| 4 | Property not included in Classes 1, 2, or 3 | 29,077 | 118,128 |

| Total parcels | 425,625 | 1,137,525 | |

Appendix: How to locate the correct property classification code