03/22/2021 Assessment Community Weekly

Spring has sprung!

Reminder: State-owned land deadline is April 12

Preliminary lists of 2021 taxable state land and taxable state conservation easements are now available in the Online Assessment Community for affected municipalities. By April 12, please review all posted documents and follow the instructions to complete the lists. If you have instructions, email orpts.statelandunit@tax.ny.gov.

Update on STAR and property tax delinquency letters and reports

Last week, the Governor issued Executive Order 202.97, which temporarily precludes the Tax Department from disallowing STAR exemptions or credits of delinquent STAR recipients if they do not pay their past-due property taxes. It also temporarily precludes the Tax Department from notifying delinquent STAR recipients of the impending disallowance of their STAR exemption or credit.

This order is in effect until April 16, 2021, but it is possible that it will be extended past that date. We will provide you with an update in mid-April.

The order does not preclude the department from collecting delinquency data from local governments, and we intend to continue doing so. This will enable us to determine if there was a change in eligibility status for any homeowners who were ineligible for a 2020 STAR benefit due to delinquency. If the delinquency was resolved after the STAR denial, the homeowner may now be eligible for a 2020 STAR benefit.

For general information about the program, see STAR and property tax delinquency.

Reminder: When properties sell

After a property sells, don’t forget to:

- transmit the sale and any changes to ORPTS (see Sales usability criteria),

- update your roll to reflect the sale inventory, and

- update the IVP record to indicate the property was sold.

2021 STAR Program Implementation Guide

Along with the Rite of Spring comes the Rite of STAR Reports. We’ll begin issuing the reports the week of April 5, but you can prepare now by reviewing the updated STAR Program Implementation Guide.

To get started, follow the steps below:

- Visit STAR information for local officials. All of the STAR Implementation Guide links are now on that page.

- Print the new, one-page STAR Report Summary.

- For more detail, print the STAR Program Actions and Reports Schedule (Legal size paper – 8.5 x 14”).

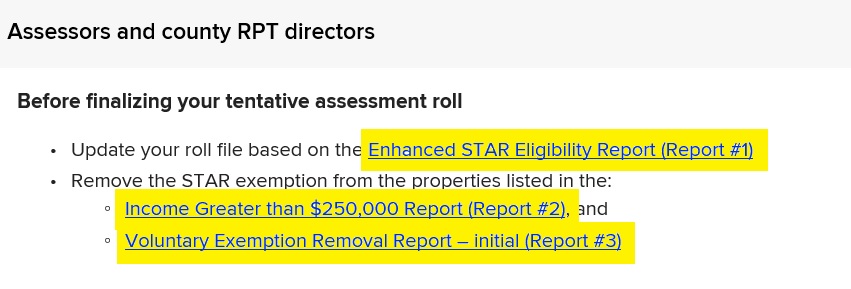

- For individual report instructions, select Assessors and county RPT directors, and select the report of your choice. For example:

New this year: You’ll use the instructions on How to submit STAR report changes to provide feedback for all of our reports. The webpage includes a template to provide feedback on a single parcel, as well as a spreadsheet for assessors with multiple changes to one report.

Watch for more details on April 5 as we get ready to issue Reports 1, 2, and 3.