VI. Apportionment

Utility mass property (electrical or gas distribution systems, electrical transmission line, gas pipeline, etc.) very often cover all or a large portion of a municipality falling into more than one school district. For taxation purposes this property must be apportioned among the school districts. These parcels always have pseudo SBL's.

Since there is no single methodology for apportioning non situs (mass property) assessment, ORPTS recommends apportionment for school districts by employing the following methodology as outlined in Opinion of Counsel Volume 7 number 121 as follows:

"The total assessment should be apportioned among the school and special districts according to each district's portion of the town - wide total assessed value (i.e., the assessed value of all real property whether taxable or exempt in whole or in part)."

It is recommended that apportionment factors for school district purposes should be carried to four (4) digits to the right of the decimal point. After the factors are determined, they should be verified by affirming that their sum (in the 'Company Apportionment' field add up to one (1.0000). Apportionment factors should appear on the RPS record.

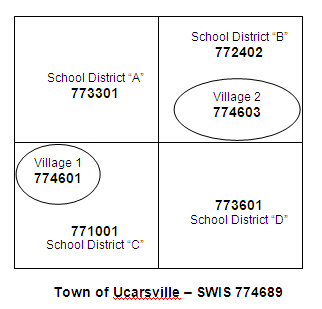

While the above methodology provides the basis for the apportionment of mass values among school districts, it does not demonstrate an extra step required for municipalities where a village or villages are present. In the example below, a map of the town of Ucarsville is shown. The town encompasses two villages and four school districts; each village is entirely within a different, single school district. The total assessed value for the town is $2,000,000, without Roll Section 6 values included.

The apportionment factors for mass utility properties for the school districts can be calculated by dividing the assessed value (AV) of the school district in the town outside the village by the total AV's of the town outside the villages. Referring to the graphic below, the total assessed value for the town outside the village (TOV) is $1,750,000. Calculations for district – "A" factor = $500,000/$1,750,000 or 0.2857; "B" factor = $600,000/$1,750,000 or 0.3429; "C" factor = $300,000/$1,750,000 or 0.1714; and for the district “D” factor = $350,000/$1,750,000 or 0.2000.

The assessed value of the village(s) must be removed from the town factor calculation to avoid a double weight for the village portion in the calculation. This is necessary since mass utility property is inventoried and values issued by municipality. In the example, the sum of the assessed values in the district with a locational SWIS code of 772289 only should be used in the calculation. Be sure to verify your figures by summing all the assessed values in the town and village(s) to add back to the total town roll (less Roll Section 6).

Village factors for village apportionment will be 1, since the villages within this town are wholly within a single school district. An example of an apportionment entry in the description 2 field would appear as: App Factor 1.0000. The factor of 1 will be used unless a school district line splits the village, which would require an apportionment process as explained above.

| School district | Loc | AV | AV TOV | Factor |

|---|---|---|---|---|

| 773301-A | 774689-tov | 500,000 | 500,000 | 0.2857 |

| 772402-B | 774603-vil | 100,000 | 600,000 | 0.3429 |

| 774689-tov | 600,000 | |||

| 771001-C | 774601-vil | 150,000 | 300,000 | 0.1714 |

| 774689-tov | 300,000 | |||

| 773601-D | 774689-tov | 350,000 | 350,000 | 0.2000 |

| 2,000,000 | 1,750,000 | 1.000 |

| Back to Index | | Previous |