02/16/2021 Assessment Community Weekly

2021 Tentative special franchise values

We have mailed the 2021 tentative values to all municipalities outside of New York City. If you haven’t received yours already, you will shortly.

ICYMI: How you can help new Enhanced STAR recipients switch to the STAR credit

Last week we shared detailed information to help you assist seniors who want to switch to the STAR credit from the STAR exemption, primarily:

- If they call 518-457-2036 to register for the STAR credit, they should tell the representative that they want to switch to the STAR credit. (If they say they want to register for the Enhanced STAR exemption, the representative may refer them back to their assessor.)

- If they register for the STAR credit online, in the beginning of the application process they should select Make the switch. That will prompt us to include them on the Voluntary Exemption Removal Report, and you’ll know that you must remove their STAR exemption from the assessment roll.

For the details, see our February 10 announcement.

Why do we still have a Basic STAR form if we can’t grant new Basic STAR exemptions?

Thanks to Edye McCarthy for asking this question that we bet many of you may have.

As noted in the instructions on page 2 of Form RP-425-B, Application for Basic STAR Exemption, the form is available on our website for specific cases where existing STAR exemption recipients need to reapply due to ownership changes. Such cases include the following:

- marriage

- divorce

- surrender of interest by a co-owner

- survivorship

- trusts

- life estates

- name changes

How to search the property tax content on our website

We’ve improved the functionality of our property tax-focused searches. Here are some tips for using them.

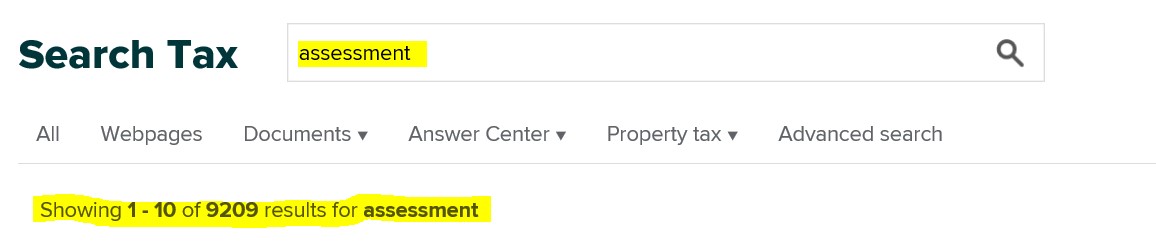

- To access the focused searches, first select the magnifying glass in the search box on any page.

- Once on the main search page, enter your search term. This search will return results from the entire website.

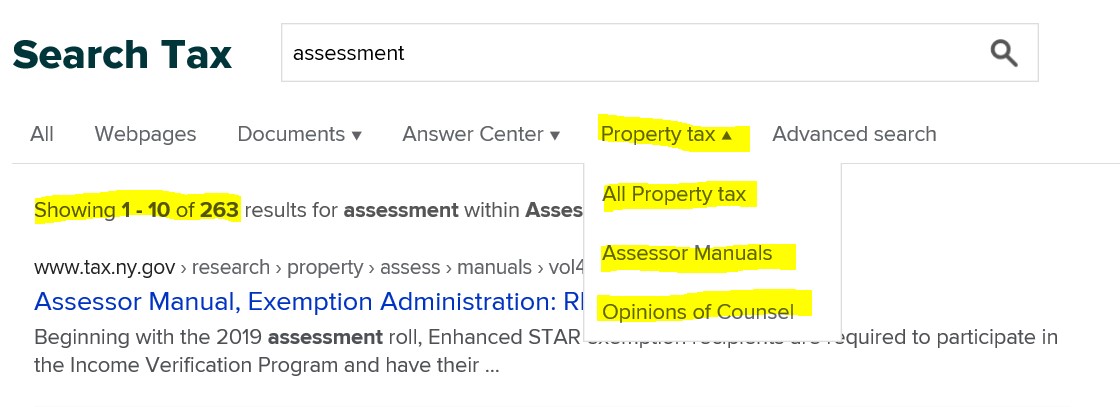

- To narrow your search, select Property tax and choose from the available options. The search then narrows to your chosen category.

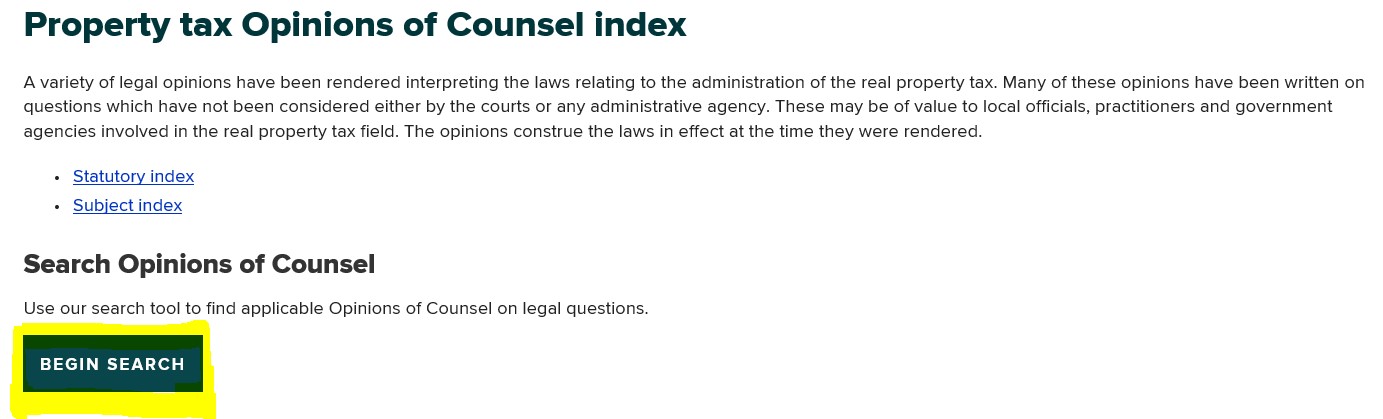

- To search the ORPTS Opinions of Counsel, you can choose from the drop-down menu highlighted above, or you can search directly from the Opinions of Counsel webpage.

(Hat tip to Onondaga County Real Property Tax Director Don Weber for letting us know that the search above wasn’t working. We’ve fixed it!)

Judicial case

We’ve added NYCTL 2016-A Trust v Neighborhood Youth & Family Servs., Inc. to Judicial cases.