03/15/2021 Assessment Community Weekly

Top of the Ides of March to ya!

Important tips for last minute IVP transmissions

While the deadline has passed, if you’re still sending us last minute IVP forms, please keep in mind these instructions:

- Use a transmittal coversheet for every batch.

- List the actual number of forms you are transmitting on each cover sheet. Do not put the number of pages in that field.

- If you’re sending physical forms, do not use staples. We have to remove them to process the forms.

- When scanning forms for submittal make sure that they are upright. Upside down forms require extra processing steps.

- Do not use regular email to send IVP forms; it is not secure. However, a secure email account (SCOM) meets the requirements for Internet security. SCOM tips:

- To request a secure account, email ivpforms@tax.ny.gov and include your name, phone number and email address. We can only provide one account per municipality.

- If you are responsible for multiple municipalities, you only need one SCOM account. You can submit forms for any of your municipalities from the same SCOM account. But please batch each municipality’s forms separately.

- If you need your SCOM password reset, email ivpforms@tax.ny.gov.

For the full list of instructions, see How to transmit IVP forms to the Tax Department.

Tentative railroad ceilings

We’ve issued tentative railroad ceilings to 342 impacted municipalities and 23 companies. A virtual hearing will be held if any complaints are filed.

Change to Online Assessment Community login

In the upcoming days, the login for the Online Assessment Community will look a little different. The good news is that your user ID and password won’t change due to this tweak:

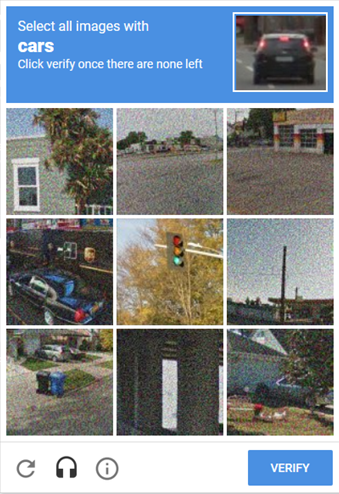

However, to improve security, you will now have to respond to CAPTCHA each time you log in:

If you have issues getting past the captcha, try using a browser other than Internet Explorer, such as Chrome or Firefox.

FYI: annual request for special franchise reports sent to municipal clerks

We sent the below email to municipal clerks last week. Note that we encourage the clerks to work closely with assessors to complete the form.

Please take a moment to complete Form RP-7114, Municipal Report of Special Franchise Activity, for the 2020 calendar year.

Use Form RP-7114 to report:

- special franchise boundary changes,

- new special franchise, and

- construction in the public right of way.

We ask that all municipalities complete this form, even if there were no changes last year. If there were no changes, simply:

- enter the name and SWIS code in Part 1,

- select No in Part 2,

- enter NA in Parts 3 and 4, and

- ask your supervisor or mayor to complete Part 6.

By April 15, please return the form and any attachments to the mailing address, fax, or email on the form. If you have questions, email ORPTS.Utility.Reports@tax.ny.gov.

While municipal clerks are responsible to complete and submit the form, we encourage you to work closely with your assessor and submit one form per municipality.

About special franchise property

Form RP-7114 captures changes to special franchise properties, which are assessed by New York State rather than by your assessor. By providing us with this information, you will help us to ensure that the assessments are accurate for your municipality.

Special franchise property generally includes all tangible utility real property that is:

- located in, under, upon or above public places, such as streets, highways, water or other public places, and

- not owned by the municipality.