Lost, stolen, destroyed, and uncashed checks

If your refund check is lost, stolen, or destroyed, contact the Personal Income Tax Information Center at 518-457-5181. You will need a copy of your most recently filed tax return when you call.

Uncashed refund checks

If you still have your tax refund check, cash it now even if you received Form DTF-36, Application for an Uncashed Check. (Note: Once you cash the check, there is no need to complete the DTF-36.)

If you do not have your tax refund check and need a replacement, you should automatically receive Forms DTF-32, Notification to Owner of an Uncashed Check, and DTF-36, Application for an Uncashed Check. Just complete, sign, and return them no later than the response date on the forms.

If you have a jointly issued check for you and your deceased spouse

If your refund check is jointly issued to you and your deceased spouse, you may be able to deposit or cash the refund at your bank.

If you have a refund check for someone else who is deceased

If the deceased individual received Forms DTF-32, Notification to Owner of an Uncashed Check, and DTF-36, Application for an Uncashed Check, and:

- their notices are more than one year old, contact the State Comptroller's Office of Unclaimed Funds or call 1-800-221-9311 for assistance, or

- their notices are less than one year old, have the beneficiary or estate administrator for the deceased submit the signed and completed notices to:

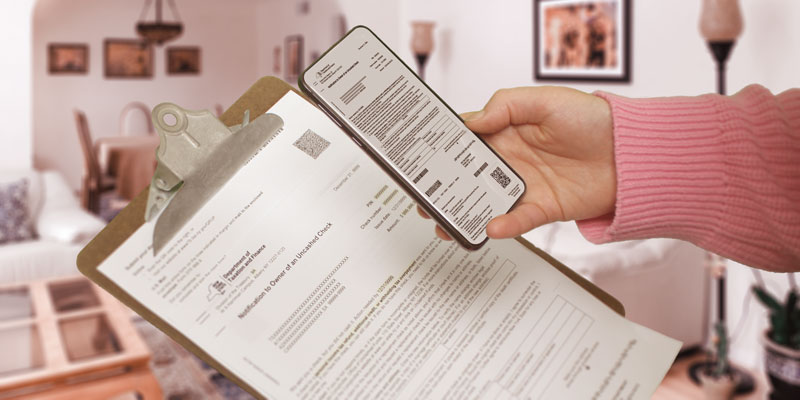

Scan snap submit ad

Scan, snap, submit!

Did you receive a letter asking you to complete Form DTF-32, DTF-33, DTF-36, TD-210.2, TD-210.3, or TD-210.7?

To receive your new check sooner, use your mobile device to submit your form online!

- Scan the QR code on your letter.

- Snap a photo of your completed form.

- Submit your photo.

Benefits include:

- security, without the hassle of an account

- no printer or computer required

- instant confirmation we received your form