Tax professionals

Tax professional Resources

Assist your client online

Access your client's information

Learn about your responsibilities

Find what you're looking for

Important Information

Tax preparer and facilitator registration

The 2025 tax preparer registration application is now available. Tax preparers and facilitators can register for the first time or renew their registration now using the Tax Department’s online application.

Protect yourself from data security breaches

Here are some tips and best practices that can help you protect your clients’ data and your own business.

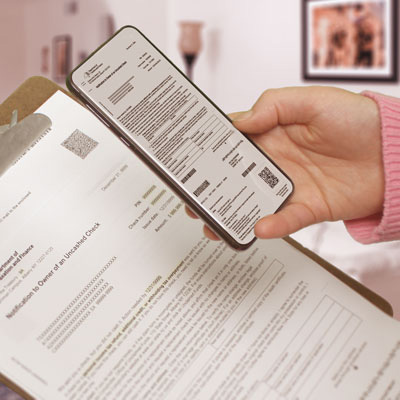

Scan, snap, submit!

If your client receives Form DTF-32, DTF-33, DTF-36, TD-210.2, TD-210.3, or TD-210.7, they have an uncashed check from us.

For the fastest processing of a new check, they should complete the form we mailed, then:

- Scan the QR code on the letter.

- Snap a photo of the completed form.

- Submit the photo.

Additional Tools

Plan Ahead

Pay your client's bill or notice

You can make a payment or request a payment plan for your client using one of our convenient online options.

Learn what we're mailing

Did your client receive a letter, bill, notice, or check? Visit our letter resource center for the latest information on what we're mailing.