Subscribe to this page

Sign up to receive email updates when we update this page.

Find answers to your questions about the STAR program, as well as STAR Credit Direct Deposit and the Homeowner Benefit Portal.

The School Tax Relief (STAR) program offers property tax relief to eligible New York State homeowners. If you’re eligible and enrolled in the STAR program, you’ll receive your benefit each year in one of two ways:

Whether you receive the STAR exemption or the credit, there is a Basic STAR benefit and an Enhanced STAR benefit. For more information, see Types of STAR benefits.

Homeowners with incomes under $500,000 are generally eligible for the STAR credit on their primary residence. For details, see STAR eligibility.

To view whether you are receiving the STAR credit or the STAR exemption, access the Homeowner Benefit Portal by logging into your Tax Department Individual Online Services account.

If you do not have an Individual Online Services account, create one.

Once you have an Individual account:

The main difference is that the STAR exemption reduces your school tax bill while the STAR credit results in a direct payment to you. Another difference is that you may receive a larger benefit if you switch to the STAR credit. To compare what you would have received had you switched in a prior year, see Compare STAR credit and exemption savings amounts. See STAR eligibility to review additional differences.

See Register for the STAR credit, which includes the required information you'll need before you start.

We recommend you register as soon as possible after you move into your new home. However, we’ll accept your registration for up to three years from the income tax filing deadline for the year covered by the credit. For example, to claim the STAR credit for 2024, you must register by April 15, 2028.

No. Once you’ve registered, we’ll automatically review your eligibility for the credit every year for as long as you continue to own and occupy your home.

No. The department makes one payment to all resident owners of a property. If multiple owners wish to divide the STAR credit benefit, they must make arrangements among themselves.

You may be. Manufactured homeowners are eligible for the STAR credit if they meet all the STAR eligibility criteria.

You should expect to receive the credit around the time you receive your school tax bill. Use our STAR Credit Delivery Schedule lookup for the most recent delivery information for your area.

See How to report your property tax credits.

State law allows for interest to be paid on STAR credits only if you registered on or before July 1 of the year of the credit. However, even if you registered on or before July 1, your eligibility for interest depends on when your school district’s tax roll was filed with the Tax Department. Specifically, if the school tax roll was filed with us:

Note: Payments for cooperatives and manufactured homes may be on a different schedule.

If you are entitled to interest, we’ll automatically add it when we issue your credit.

You will become eligible for the STAR credit in the first year that you own the home and it is your primary residence as of the date that school taxes are due.

Example 1: If the school taxes in your community are due by September 30, and you purchase the home on September 15, you will become eligible for STAR that year, as long as you Register for the STAR credit and meet the eligibility criteria.

Exception: If the prior owner had been receiving a STAR exemption on the home, and the sale occurred after the local taxable status date (generally March 1), his or her STAR exemption will be carried over to your first school tax bill, and you will begin receiving the STAR credit the following year.

Example 2: If the school taxes in your community are due by September 30, and you purchase the home on October 15 (after school taxes are due), you will become eligible for the STAR credit the following year, as long as you register and meet the eligibility criteria.

The law does not allow STAR exemptions to be transferred to newly purchased homes. The STAR credit is available to homeowners in your situation.

Yes. The reason you received the STAR exemption on your first school tax bill is because the previous owner of your home was granted the STAR exemption. Their exemption remained in place in the first year you owned the home, but you are not entitled to keep their STAR exemption beyond that. You must register for the STAR credit to receive a STAR benefit in the future.

By law, to receive the STAR exemption now, you must have received it in 2015. Because you weren't receiving the STAR exemption on the property in 2015, you're not eligible to receive the exemption. However, you may still register with the Tax Department for the credit. See When should I register?.

If you want to receive the STAR credit instead of the exemption, it may be to your advantage. However, once you switch to the STAR credit, you cannot switch back to the exemption.

To receive the STAR credit, access the Homeowner Benefit Portal in your Individual Online Services account:

Yes. If you change residences, you must re-register for the STAR credit for your new property in order to receive the benefit on your new home. See Register for the STAR credit.

Yes. Log in to your Individual Online Services account to view your existing registration.

After you log in, select the ≡ Services menu in the upper-left corner of your screen. You’ll find the link for Homeowner Benefit Portal in the Real property tax menu.

To update a registration, select Actions and choose Edit Registration from the drop-down menu.

A: No. If you received the STAR exemption in 2015 and you continue to own the home, you’re eligible to continue receiving the exemption.

No. As long as you continue to live in the home and you’re either the trust beneficiary or life tenant, you’re eligible to continue receiving the exemption. For more information on trusts, life estates, and STAR, see STAR eligibility.

The Homeowner Benefit Portal allows you to:

To access the Homeowner Benefit Portal, log in to your Tax Department Individual Online Services account. After you log in, select the ≡ Services menu in the upper-left corner of your screen. You’ll find the link for Homeowner Benefit Portal in the Real property tax menu.

To check the status of your property tax benefit registration, access the Homeowner Benefit Portal by logging in to your Tax Department Individual Online Services account. After you log in, select the ≡ Services menu in the upper-left corner of your screen. You’ll find the link for Homeowner Benefit Portal in the Real property tax menu. You can view your registration status in the left column under Registrations on file.

If you’re a STAR credit recipient, you may now have your STAR credit deposited directly into your bank account, rather than receive a check. STAR Credit Direct Deposit is the fastest and easiest way to receive your STAR credit.

When you choose direct deposit, you’ll

No. The STAR Credit Direct Deposit program is a voluntary program.

Use the Homeowner Benefit Portal to enroll in STAR Credit Direct Deposit. To access the Homeowner Benefit Portal, log in to your Individual Online Services account.

If you do not have an Individual Online Services account, create one. You cannot use a Business, Tax Professional, or Fiduciary account to enroll in STAR Credit Direct Deposit.

Once you have an Individual account:

To ensure you receive your STAR credit by direct deposit this year, enroll as soon as possible. If you enroll fewer than 15 days before we issue your STAR credit, you’ll receive a check this year and your direct deposits will begin next year.

To find out when we’ll issue STAR credits in your area, use our STAR Credit Delivery Schedule lookup.

No. To receive your STAR credit by direct deposit, you must enroll in the STAR Credit Direct Deposit program through the Homeowner Benefit Portal in your Individual Online Services account.

No. You’ll remain enrolled in the program unless you discontinue your enrollment.

No. You may receive either the STAR credit or the STAR exemption, not both. The STAR exemption is a reduction of tax on your school tax bill, not an amount we can issue to you by check or direct deposit.

Interested in learning more about the STAR credit? See the STAR resource center to learn more.

No. You will not need to contact your bank to enroll in STAR Credit Direct Deposit.

If you do not have a bank account, you cannot enroll in STAR Credit Direct Deposit.

However, as long as you’re registered and eligible, you’ll continue to receive a STAR credit check.

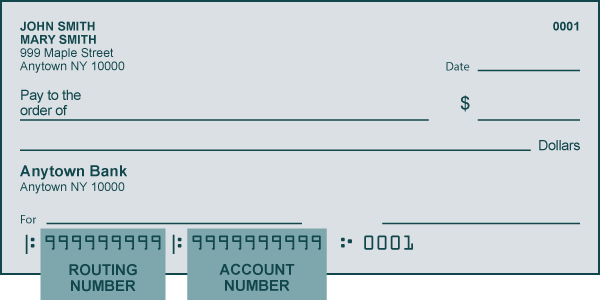

You can find your routing and account numbers on your checks, and often in your online bank account (if you have one). You can also contact your bank.

Here’s a sample check with the routing and account numbers highlighted:

No. STAR credits may be deposited only into a personal checking or savings account, or mailed to you as a check.

Yes. We’ll deposit your STAR credit into the account you specify in your STAR Credit Direct Deposit enrollment.

No. The STAR credit may be deposited into only one bank account.

While the text that appears on your bank statement may vary, it should include the words New York State, the abbreviation NYS, or something similar. If you don’t know whether your STAR credit has been deposited, use our Property Tax Credit Lookup to see whether we’ve issued it.

To check the status of your STAR Credit Direct Deposit enrollment, access the Homeowner Benefit Portal by logging into your Tax Department Individual Online Services account.

As long as you’re registered and eligible for the STAR credit, you may expect to receive your STAR credit before the deadline for your school taxes. If we cannot deposit using the bank account you provide, or if you enroll in STAR Credit Direct Deposit fewer than 15 days before we issue your STAR credit, you’ll receive a check.

To find out when we’ll issue STAR credits in your area, use our STAR Credit Delivery Schedule lookup.

You must pay your school district taxes by the deadline, whether or not you have received your STAR credit. If you do not, you will be subject to interest, penalties, or both.

If you were expecting to receive a STAR credit by direct deposit before your school taxes were due, there may be a simple explanation as to why you did not. We recommend you:

Still have questions? Contact the Tax Department’s STAR telephone line Monday through Friday from 8:30 a.m. to 4:30 p.m.

If your name or mailing address changes, update your STAR credit registration in the Homeowner Benefit Portal.

If we cannot deposit your STAR credit using the bank account information you provide, you’ll receive a check for the STAR credit. You may update your STAR Credit Direct Deposit enrollment to change your banking information.

To discontinue your enrollment in STAR Credit Direct Deposit:

Note: If you choose to discontinue your enrollment, as long as you are registered and eligible, we will send a STAR credit check to the mailing address we have on file. You can re-enroll in STAR Credit Direct Deposit at any time.

Yes. If you purchase a new home, you must register for the STAR credit to receive the benefit on your new home. For more information, see Register for STAR or update your STAR registration.

As part of your new registration, you will have the option to enroll in direct deposit. Bear in mind that, if you no longer own your primary residence, you are not eligible for the STAR credit.

No. You will not have to re-enroll in STAR Credit Direct Deposit if you become eligible again in future years.

If you're a homeowner, you can use our portal to:

All you need is an Individual Online Services account.

Sign up to receive email updates when we update this page.