Filing Period Indicators on Final Sales Tax Returns

Tax Bulletin ST-270 (TB-ST-270)

Printer-Friendly Version (PDF)

Issue Date: March 26, 2010

Introduction

Businesses file sales tax returns on an annual, quarterly, or part-quarterly (monthly) basis. New York State sales tax returns are designed with a filing period indicator to identify the sales tax period so your payment can be properly credited to you by the Tax Department. This is usually not a problem since the taxpayer files the proper return for each tax period in sequence. It can become a problem when a business closes and needs to file a final sales tax return. This bulletin explains:

- where to find the filing period indicator on your return,

- how to determine whether it is correct, and

- how to change it if it is not correct.

This bulletin is only applicable to a business that files a paper final return. The filing period indicator on a Web File return cannot be changed. If you normally Web File your return and the return for the final sales tax period of your business is not yet available, you will need to file a final paper return and make the changes to that return as described in Tax Bulletin Filing a Final Sales Tax Return (TB-ST-265). If the Web File return for the correct filing period is available at the time your final return is due, use the Web File return. You must file your final return within 20 days after you stop doing business or are otherwise required to surrender your Certificate of Authority.

Where to find the filing period indicator on your return

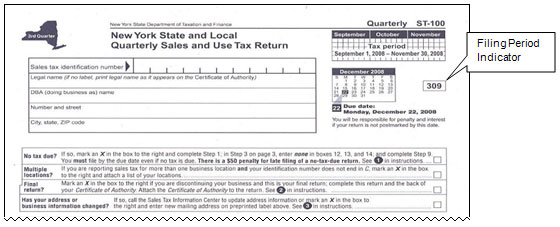

The filing period indicator appears in the upper right-hand area of your New York State sales tax return (see below). Part-quarterly (monthly) filers have a four-character filing period indicator. All other filers have a three-character filing period indicator.

How to determine if the filing period indicator is correct

1. Last two characters of the filing period indicator

For all filers, the last two characters of the filing period indicator are the last two digits of the calendar year in which the sales tax year ends. Unlike the calendar year, the sales tax year begins on March 1 and ends on February 28 (or 29) of the following calendar year. For example, if the last two characters of the filing period indicator are 09, the period covered would be part of the sales tax year March 1, 2008, to February 28, 2009.

2. First characters of the filing period indicator

Annual filers (Form ST-101, New York State and Local Annual Sales and Use Tax Return):

- The first character of the three-character filing period indicator is always A.

For example, the filing period indicator A10 applies to annual filers filing in 2010.

Quarterly filers (Form ST-100, New York State and Local Quarterly Sales and Use Tax Return):

- The first character of the three-character filing period indicator is the number of the quarter in the sales tax year:

- March 1 - May 31 = 1

- June 1 - August 31 = 2

- September 1 - November 30 = 3

- December 1 - February 28 (or 29) = 4

For example, the filing period indicator for the quarter of June 1, 2009, through August 31, 2009, would be 210 (second quarter of the 2010 sales tax year).

Part-quarterly (monthly) filers:

- The first two characters of the four-character filing period indicator represent the number of the month in the sales tax year.

- Because the sales tax year begins in March, March is 01, April is 02, and February is 12, the end of the tax year.

For example, the filing period indicator for April 2009 for a part-quarterly filer would be 0210 (second month of the 2010 sales tax year).

Final return filing period indicators

The filing period indicator on your final sales tax return is determined by the date you stop doing business.

1. Annual filers (Form ST-101)

| If you stop doing business between: |

use filing period indicator: |

| March 1, 2009 - February 28, 2010 | A10 |

| March 1, 2010 - February 28, 2011 | A11 |

2. Quarterly filers (Form ST-100)

| If you stop doing business between: |

use filing period indicator: |

| March 1, 2009 - May 31, 2009 | 110 |

| June 1, 2009 - August 31, 2009 | 210 |

| September 1, 2009 - November 30, 2009 | 310 |

| December 1, 2009 - February 28, 2010 | 410 |

| March 1, 2010 - May 31, 2010 | 111 |

| June 1, 2010 - August 31, 2010 | 211 |

| September 1, 2010 - November 30, 2010 | 311 |

| December 1, 2010 - February 28, 2011 | 411 |

3. Part-quarterly filers (Forms ST-809 and ST-810)

Part-quarterly filers must use Form ST-810, New York State and Local Quarterly Sales and Use Tax Return for Part-Quarterly Filers, to file their final sales tax return.

If you were in business during any part of the first two months of the sales tax quarter, you must also file Form ST-809, New York State and Local Sales and Use Tax Part Quarterly Return.

For example: if you are a part-quarterly filer and stop doing business on February 6, 2010, you must:

- timely file Form ST-809 for the months of December 2009 and January 2010; and

- file Form ST-810 as your final return for the period December 1, 2009, through February 6, 2010.

| If you stop doing business between: |

use filing period indicator: |

| June 1, 2009 - August 31, 2009 | 0610 |

| September 1, 2009 - November 30, 2009 | 0910 |

| December 1, 2009 - February 28, 2010 | 1210 |

| March 1, 2010 - May 31, 2010 | 0311 |

| June 1, 2010 - August 31, 2010 | 0611 |

| September 1, 2010 - November 30, 2010 | 0911 |

| December 1, 2010 - February 28, 2011 | 1211 |

How to change the filing period indicator

If you file a final return by using a return from a prior period, the filing period indicator preprinted on your return will be incorrect.

To change the period indicator:

- cross out the preprinted filing period indicator; and

- write in the correct filing period indicator in the area where the printed filing period indicator is located.

Note: A Tax Bulletin is an informational document designed to provide general guidance in simplified language on a topic of interest to taxpayers. It is accurate as of the date issued. However, taxpayers should be aware that subsequent changes in the Tax Law or its interpretation may affect the accuracy of a Tax Bulletin. The information provided in this document does not cover every situation and is not intended to replace the law or change its meaning.

References and other useful information

Bulletins: