Tax Relief Being Mailed to Eligible New Yorkers

$475 million in additional New York State child and earned income tax payments is being sent to about 1.8 million people

For Release: Immediate,

For media inquiries only, contact:

The New York State Department of Taxation and Finance today announced it has started mailing additional financial relief to eligible New Yorkers. The Tax Department is issuing $475 million in additional New York State child and earned income tax payments to about 1.8 million people. Most of the checks should arrive by the end of October.

The checks are automatically being mailed to those who received the Empire State Child Credit or the Earned Income Credit, or both, on their 2021 state tax returns. No action is required by taxpayers.

“We’re delivering these relief checks to hardworking New Yorkers who’ve been feeling the pinch of inflation,” said Acting Commissioner of Taxation and Finance Amanda Hiller. “The average payment is about $270 for each recipient, which will help address rising costs associated with the pandemic and inflation.”

Eligible New Yorkers must have filed their 2021 New York State resident income tax return by April 18, 2022, or had a valid extension of time to file. They will not need to report the payment on their income tax return.

New Yorkers are entitled to a payment if, for tax year 2021, they received at least $100 for either or both of the following credits from New York State:

- an Empire State child credit

- a New York State earned income credit (or noncustodial parent earned income credit)

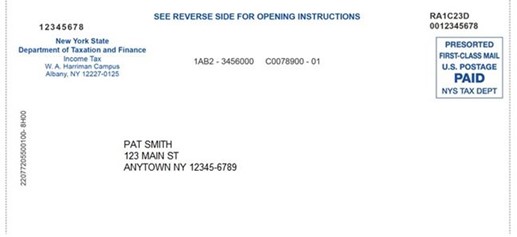

Eligible New Yorkers will receive a check in the mail that looks like the one pictured below.

###