Tips and reminders: Form IT-2104, Employee’s Withholding Allowance Certificate

Complete Form IT-2104 so that your employer can withhold the correct state and local income taxes from your pay. Consider completing a new IT-2104 each year and when your personal or financial situation changes.

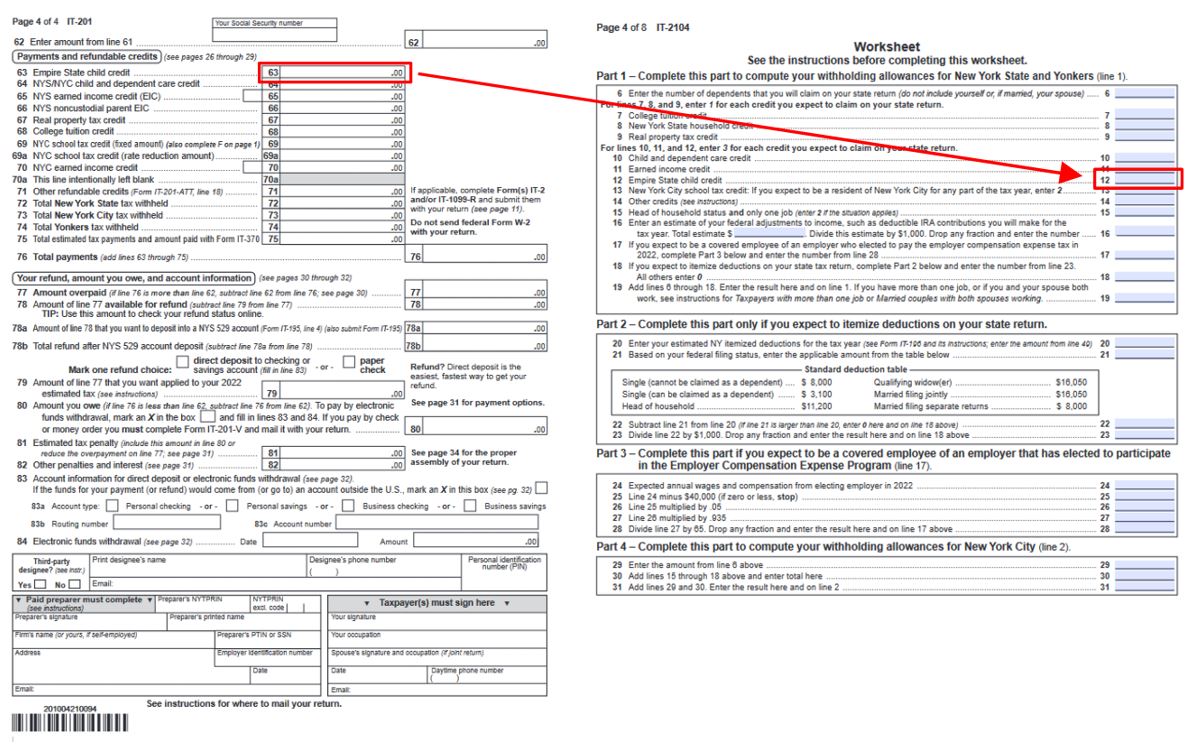

The information you provide on Form IT-2104 determines how much money your employer withholds from each paycheck. Every allowance you are eligible to claim reduces the amount of money withheld, which means more money in your pocket during the year.

To ensure you are aware of every allowance you are eligible for, we recommend you complete the worksheet that accompanies Form IT-2104. However, if any of the following apply to you, you may not need to complete the worksheet:

- this is your only job

- you cannot be claimed by someone else as a dependent

- you do not have children

- you are not married

- you do not qualify to claim any credits

Before you begin

- If you are not sure what allowances you can claim:

-

- Get a copy of your last income tax return.

- Look to see what has changed since you filed.

- If nothing has changed, use it to guide you through the worksheet. Many of the credits on your return can be directly carried over to the worksheet:

- If you have not filed a prior year return, or this is your first tax return, check if you qualify for any income tax credits before you request the corresponding allowances. See Income tax credits.

When completing Form IT-2104

- Do not use Form IT-2104 to claim an exemption from withholding. You must use Form IT-2104-E to claim an exemption for withholding.

- Do not claim a withholding allowance for yourself (or your spouse, if you are married).

- If you have more than $1,000 of income from sources other than wages (such as interest, dividends, or alimony received), reduce the number of allowances (line 1 and 2 of Form IT-2104) by one for each $1,000 of nonwage income.

- If you and your spouse are both employed, file separate Forms IT-2104 with each of your employers.

- If you have more than one job, file a separate Form IT-2104 for each of your employers.

- If you are a dependent of another taxpayer and expect your income to exceed $3,100, reduce your withholding allowances by one for each $1,000 over $2,500.

- If you will use the head of household filing status on your income return, mark the head of household box on Form IT-2104.

- If you owed the last time you filed your personal income tax return, claim fewer allowances to help ensure you do not under withhold. (If you do not have enough tax withheld during the year, you may find you owe tax as well as interest and penalties when you file your return.)

Updated: