Additional New York State child and earned income tax payments

This check program is closed.

We are no longer sending additional New York State child and earned income tax payments. If you believe you were entitled to a check but did not receive one, see Why didn't I receive a check?.

The 2022–2023 New York State budget provides for one-time checks to eligible taxpayers for two separate payments:

- one based on the Empire State child credit, and

- one based on the earned income credit (or noncustodial parent earned income credit).

If you qualify for a payment for one or both credits, you don't need to do anything; we will automatically calculate and send you one check that will include the total amount you’re entitled to.

Am I eligible?

You are entitled to a payment if, for tax year 2021, you received at least $100 for either or both of the following credits from New York State:

- an Empire State child credit

- a New York State earned income credit (or noncustodial parent earned income credit)

You must also have filed your New York State income tax return (Form IT-201) by April 18, 2022, or had a valid extension of time to file.

When will I get my check?

We started mailing checks to eligible taxpayers in October 2022, and continue to mail checks as we process returns.

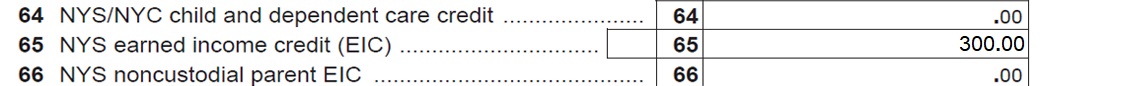

Watch your mailbox for a check that looks like this:

We cannot provide a specific delivery schedule, and our Contact Center representatives have no additional information.

How much is the check?

Your check amount will be based on your 2021 Empire State child credit, your New York State earned income credit (or noncustodial parent earned income credit), or both.

The payment for the Empire State child credit is anywhere from 25% to 100% of the amount of the credit you received for 2021. The percentage depends on your income.

The payment for the earned income credit (or noncustodial parent earned income credit) is 25% of the amount of the credit you received for 2021.

If you qualify to receive a check for:

- only one payment, your check is equal to that payment amount; or

- both payments, add together your payment amounts to determine your check amount.

Note: If you received at least $100 for either credit, your check will include a payment based on that credit. For example, if your 2021 New York State earned income credit amount was $80, and your Empire State child credit was $200, your check will only include the payment for the Empire State child credit.

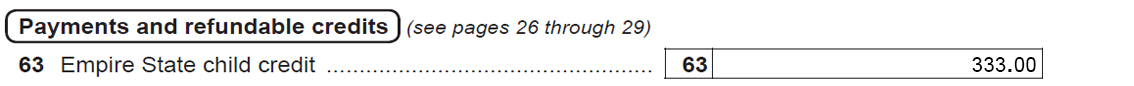

Estimate your check amount

To estimate the amount you'll receive, you'll need information from your 2021 New York State income tax return (Form IT-201). If you don’t have a copy of your return, log in to the software you used to file to view a copy, or request the information from your tax preparer (if you used one).

The actual amount you receive may be different than the amount you estimated if there were any adjustments to the amount of either credit claimed on your return. If we adjusted your credit amount, use the corrected amount in the account adjustment letter (DTF-160) or bill we sent you to estimate your additional payment.

Note: To protect your information, our Contact Center representatives cannot provide amounts from a return you filed.