Personal income tax

New York State’s largest revenue source

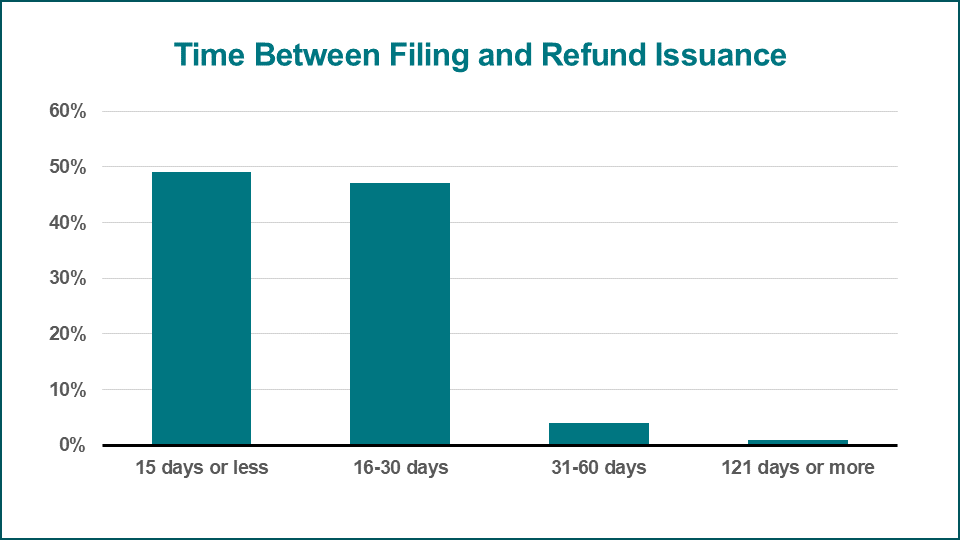

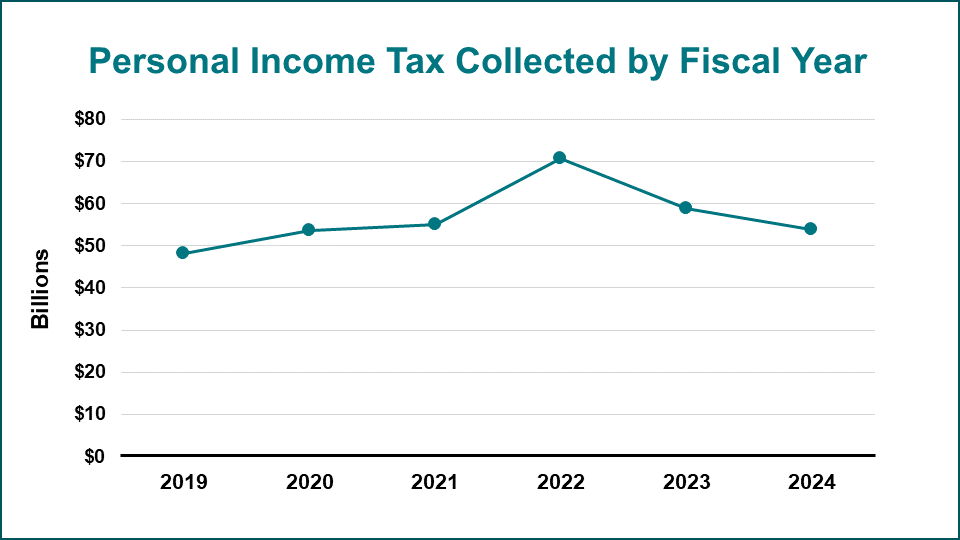

The Tax Department collected nearly $54 billion in personal income taxes in fiscal year 2023-2024. This is the state’s largest revenue source, supporting programs and services including education, health, and public safety.

Personal income tax collected in billions of dollars from fiscal years 2019 to 2024. For exact numbers, see data table.

Personal income tax filers

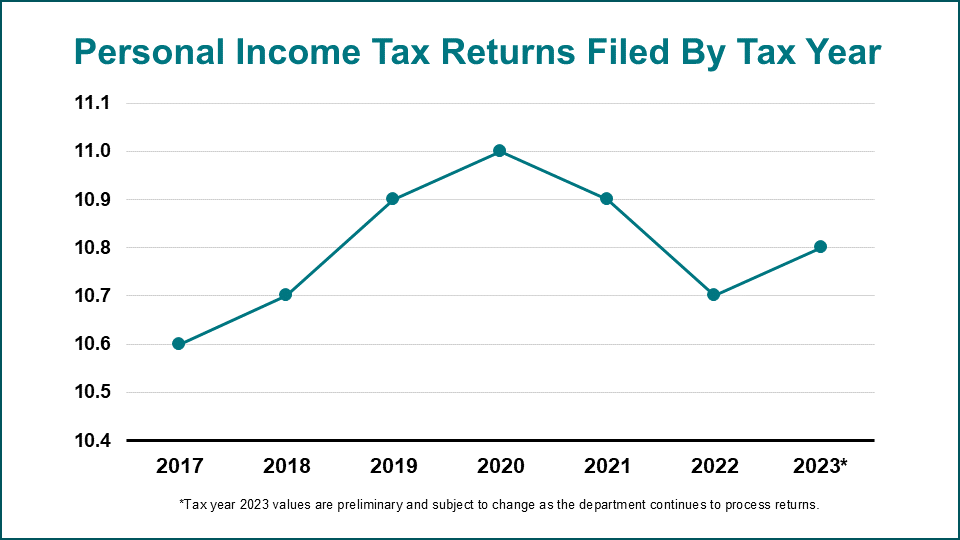

Taxpayers filed almost 10.8 million personal income tax returns in New York State in tax year 2023, down from the peak of almost 11 million personal income tax returns filed for tax year 2020 when the COVID-19 pandemic drove an expansion in government relief programs.

Personal income tax returns filed from tax year 2017 to 2023. For exact numbers, see data table.

Progressive tax system

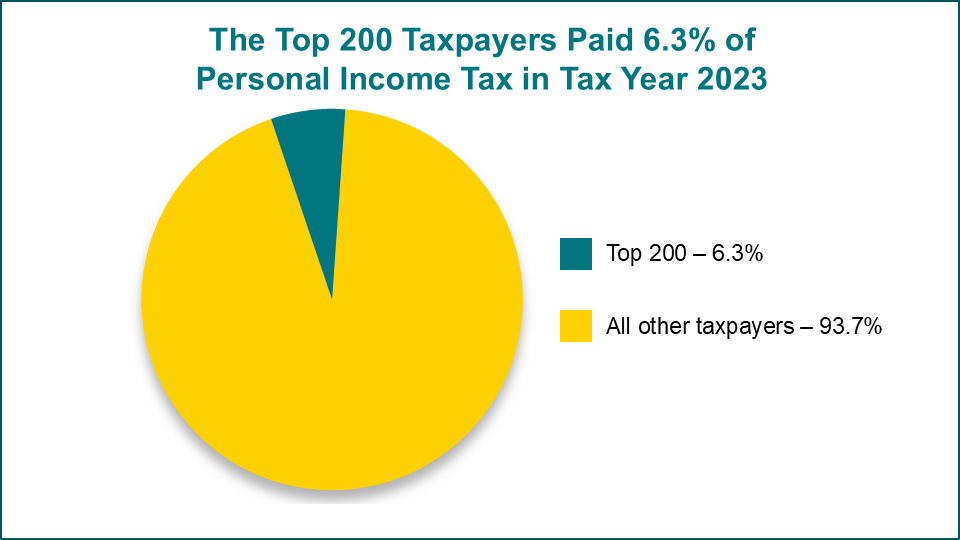

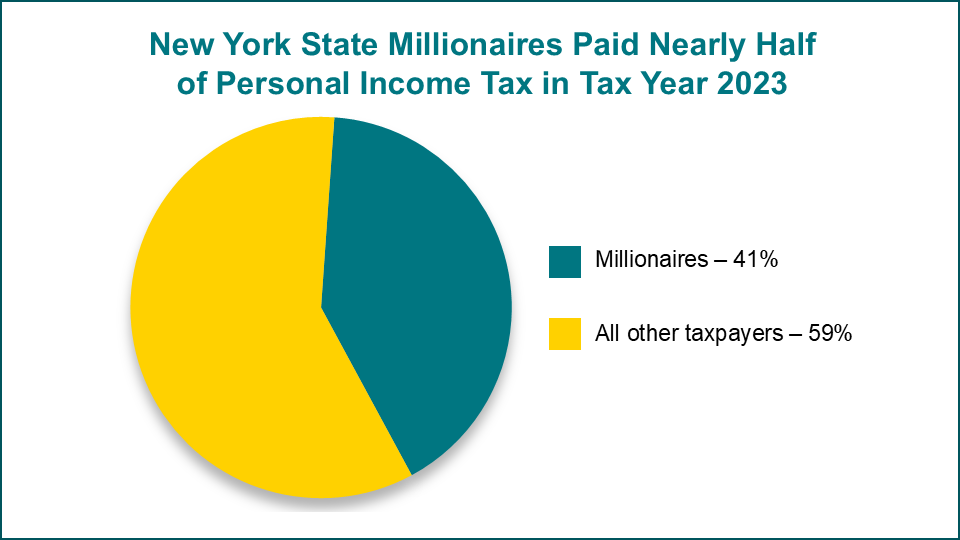

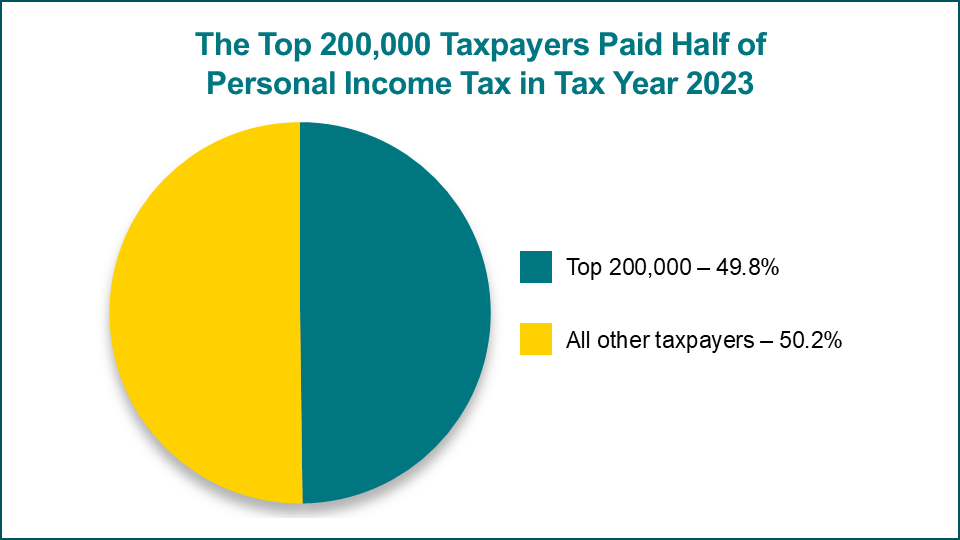

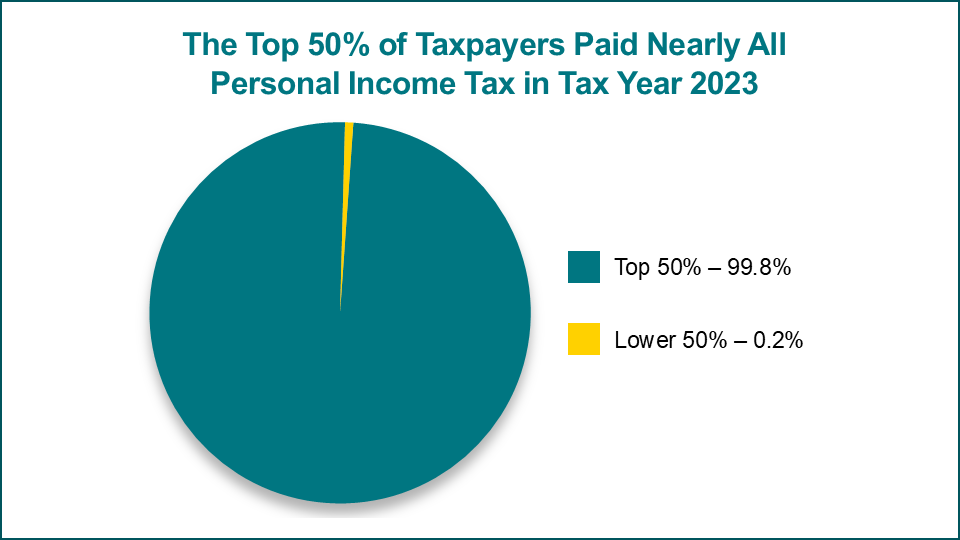

New York State's progressive tax system imposes a lower tax rate on lower-income taxpayers. A small number of high-income taxpayers pay most personal income tax.

Top 200 taxpayers paid 6.3% of personal income tax in tax year 2023: 6.3%; All other taxpayers: 93.7%.

New York State millionaires paid nearly half of personal income tax in tax year 2023: Millionaires paid 41.%; All other taxpayers: 59%.

Top 200,000 taxpayers paid half of personal income tax in tax year 2023: 49.8%; All other taxpayers: 50.2%.

Top 50% of taxpayers paid nearly all personal income tax in tax year 2023: Top 50% paid 99.8%; lower 50% paid 0.2%

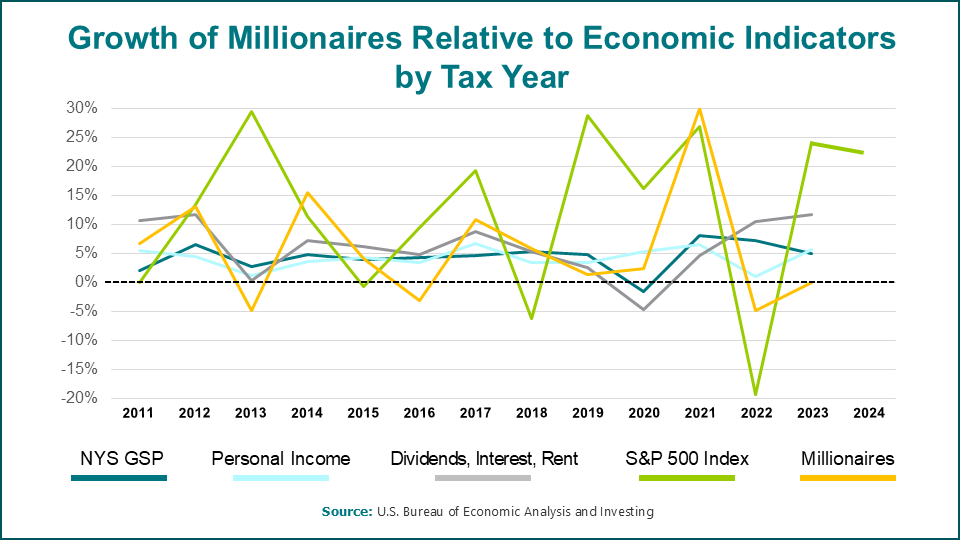

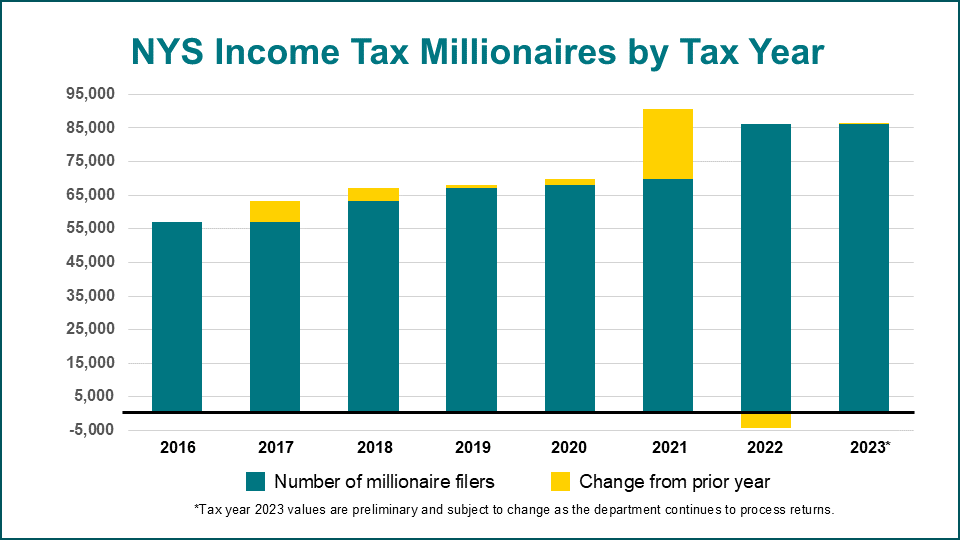

New York millionaires

After adding over 20,000 millionaires in a historically strong year in 2021, a decline in millionaire counts could be expected. Indeed, the number declined by just over 4,000 in the following year. Preliminary 2023 data has already matched 2022 and is likely to increase as the department continues to review and process tax year 2023 returns.

NYS income tax millionaires by tax year. For exact numbers, see data table.

Tax filing composition in New York State

Singles comprise the majority of resident income tax return filers.

| Filing status | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023* |

|---|---|---|---|---|---|---|---|

| Single | 48.4% | 48.9% | 49.9% | 52.1% | 51.6% | 51.1% | 51.1% |

| Married filing jointly | 32.8% | 32.6% | 31.9% | 30.3% | 30.3% | 30.7% | 30.4% |

| Head of household | 16.3% | 16.1% | 15.5% | 14.7% | 15.1% | 15.3% | 15.4% |

| Married filing separately | 2.3% | 2.4% | 2.6% | 2.8% | 2.9% | 2.8% | 3.0% |

*Tax year 2023 values are preliminary and subject to change as the department continues to process returns.

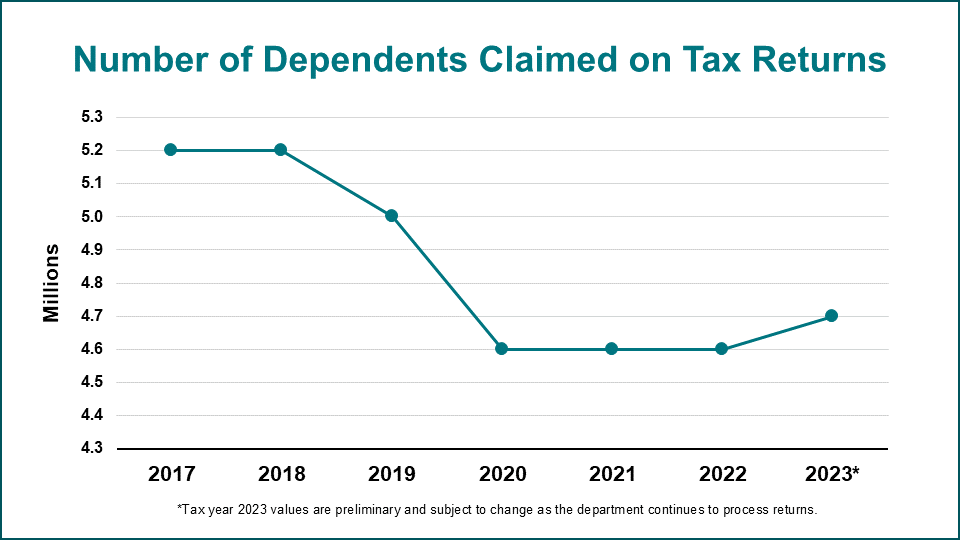

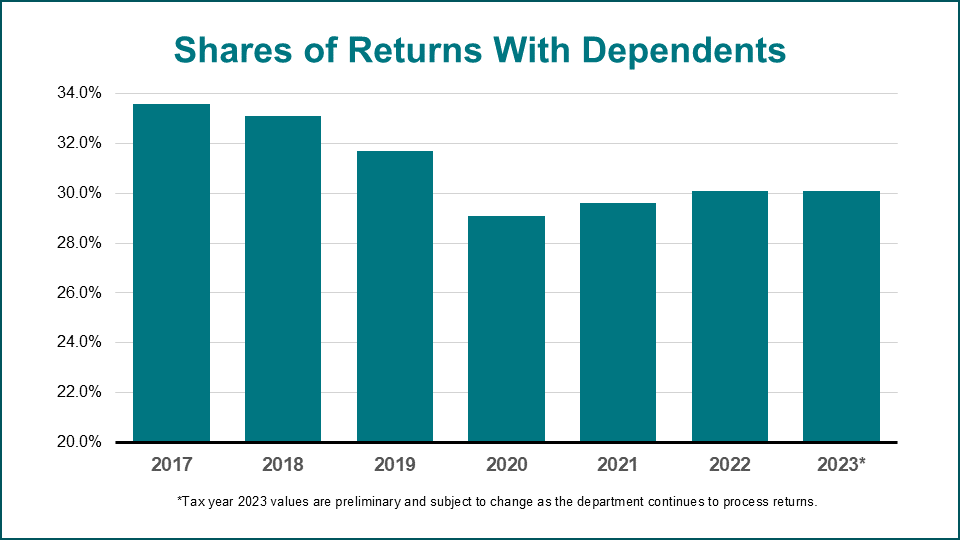

The number of dependents reported on New Yorkers' tax returns is approximately 10% fewer than in tax year 2017, but has remained relatively stable since 2020.

Difference between number of returns versus number of dependents claimed from tax year 2017 to 2023. For exact numbers, see data table.

Difference between number of returns versus number of dependents claimed from tax year 2017 to 2023. For exact numbers, see data table.

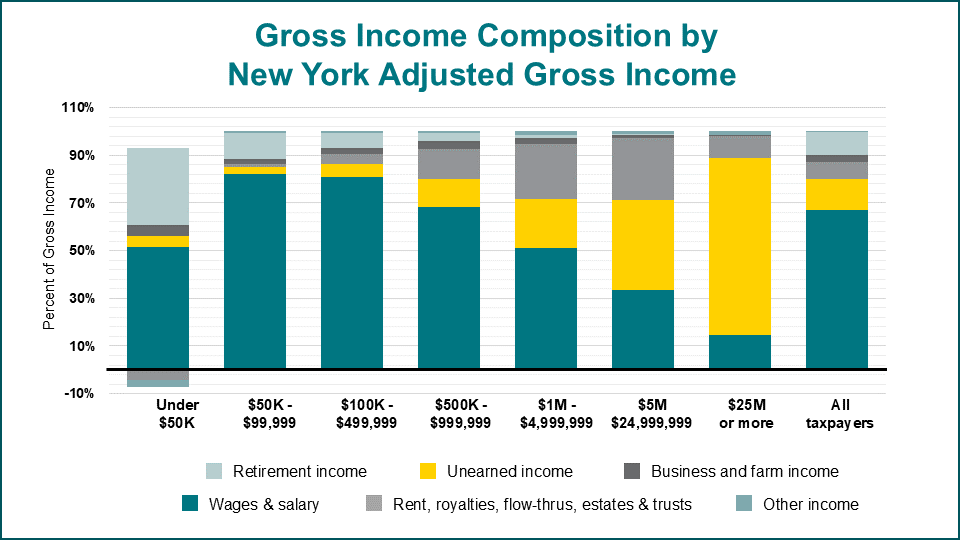

Composition of income

The nature of income varies considerably as incomes rise. For taxpayers under $1 million, the primary source of income is from wages and salary. As income rises above $1 million, however, wages and salary are displaced by other sources of income, most notably "unearned income" such as dividends and capital gains.

Composition of income types at various total income levels in New York State. For exact numbers, see data table.

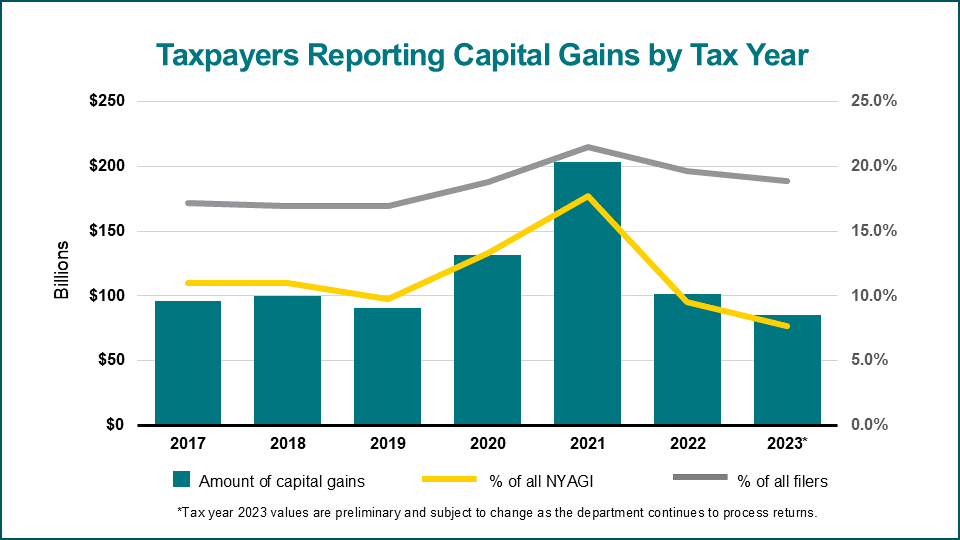

Capital gains are highly variable

Taxpayers reported over $200 billion in net capital gains in 2021, nearly doubling the annual average amount from all other years since 2017. The amounts reported in 2022 and 2023 returned to more historic levels.

However, the share of filers reporting these gains is relatively stable at around 20% of all returns.

Taxpayers reporting capital gains by tax year (2017–2023). For exact numbers, see data table.

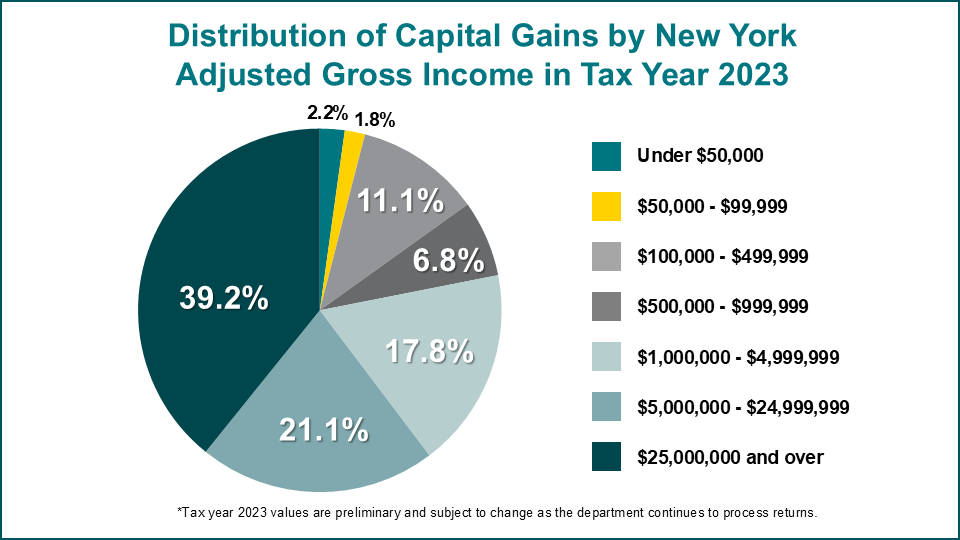

Distribution of capital gains

Capital gains are more concentrated among high-income taxpayers, with millionaires accounting for over 75% of all reported capital gains.

Distribution of capital gains by New York adjusted gross Income in tax year 2023. For exact numbers, see data table.