Department of Taxation and Finance

Instructions for Form CT-3-S New York S Corporation Franchise Tax Return

CT-3-S-I

Printer-Friendly Version (PDF)

- Form CT-1, Supplement to Corporation Tax Instructions

- Who must file

- Other forms you may need to file

- When to file

- How to file

- Penalties and interest

- Amended returns

- Filing your final return

- New York S corporation termination year

- Reporting period

- Computing corporation franchise tax

- How to fill out your tax return (Important identifying information and Signature)

- Line instructions

- Part 2 – Computation of tax

- Part 3 – Computation of business apportionment factor

- Worksheet A – Gross proceeds factors and net gains for lines 10, 12, 21, and 24

- Worksheet B – Net gains and other income for line 30

- Worksheet C – Marked to market net gains for line 28

New for 2022

For a detailed list of what’s new, including a summary of tax law changes, visit our website at www.tax.ny.gov (search: 2022).

Form CT-1, Supplement to Corporation Tax Instructions

See Form CT-1 for general instructions that apply to all corporation tax forms.

Note: All citations are to New York State Tax Law sections unless specifically noted otherwise.

Who must file

S corporations

An S corporation is a small business corporation whose shareholders have consented to the corporation’s choice of S corporation status, as permitted under Subchapter S of Chapter One of the Internal Revenue Code (IRC). Generally, an S corporation does not pay federal income tax; rather, the corporation’s income and deductions are passed through to its shareholders to report on their own personal income tax returns.

The shareholders of federal S corporations subject to Tax Law Article 9-A make a New York S election by filing Form CT-6, Election by a Federal S Corporation to be Treated as a New York S Corporation.

This includes both:

- corporations organized under New York State law, and

- foreign corporations (those organized under the laws of any other state) that do business, employ capital, own or lease property, maintain an office, or derive receipts from activity, in New York State.

Federal S corporations wishing to make the election for New York State must file Form CT-6 and receive approval before filing Form CT-3-S, New York S Corporation Franchise Tax Return, or Form CT-34-SH, New York S Corporation Shareholders’ Information Schedule. If the corporation has been approved federally, this does not mean it is automatically approved in New York State.

Once the Tax Department approves a corporation to be treated as a New York S corporation, it must file Form CT-3-S instead of Form CT-3, General Business Corporation Franchise Tax Return. Form CT-3-S is used to pay the entity level franchise tax under Article 9-A. This tax is the fixed dollar minimum tax imposed under § 210.1(d).

To report, in aggregate, the New York S corporation items that the individuals, estates, and trusts who were shareholders of the New York S corporation during any part of the year need for filing their own New York State personal income tax returns, you must attach Form CT-34-SH.

You must report to each shareholder the shareholder’s pro rata share of the S corporation items reported on Form CT-34-SH, as well as any additional information the shareholder needs for filing, including the S corporation’s business apportionment factor.

Mandated New York S corporation

Shareholders of eligible federal S corporations that have not made the election to be treated as a New York S corporation for the current tax year will be deemed to have made that election if the corporation’s investment income is more than 50% of its federal gross income for that year. For purposes of the mandated New York State S election, investment income means the sum of an eligible S corporation’s gross income from interest, dividends, royalties, annuities, rents and gains derived from dealings in property, including the corporation’s share of such items from a partnership, estate, or trust, to the extent such items would be includable in the corporation’s federal gross income for the tax year. In determining whether an eligible S corporation is deemed to have made the New York S election, the income of a qualified subchapter S subsidiary owned directly or indirectly by the eligible S corporation will be included with the income of the eligible S corporation. If deemed to have made the New York S election, the taxpayer must file Form CT-3-S.

See § 660(i)(3).

Domestic corporations

A domestic corporation (incorporated in New York State) is generally liable for franchise taxes for each fiscal or calendar year (or partial year) during which it is incorporated until it is formally dissolved with the Department of State.

However, a domestic corporation that is no longer doing business, employing capital, owning or leasing property, or deriving receipts from activity, in New York State is exempt from the fixed dollar minimum tax for years following its final tax year and is no longer required to file a franchise tax return provided it meets the requirements listed in § 209.8.

Foreign corporations

A foreign corporation (incorporated outside of New York State) is liable for franchise taxes during the period in which it is doing business, employing capital, owning or leasing property, maintaining an office, or deriving receipts from activity, in New York State.

A corporation is doing business in this state if:

- it has issued credit cards (including bank, credit, travel, and entertainment cards) to 1,000 or more customers who have a mailing address in this state as of the last day of its tax year;

- it has merchant customer contracts with merchants and the total number of locations covered by those contracts equals 1,000 or more locations in this state to whom the corporation remitted payments for credit card transactions during the tax year; or

- the sum of the number of customers and the number of locations equals 1,000 or more.

See § 209.1(c).

For a foreign corporation that is a partner in a partnership, see Corporate partners.

A foreign corporation is not considered to be doing business, employing capital, owning or leasing property, maintaining an office, or deriving receipts from activity, in this state if their activity is limited to any or all of the following:

- the maintenance of cash balances with banks or trust companies in this state;

- the ownership of shares of stock or securities kept in this state if kept in a safe deposit box, safe, vault, or other receptacle rented for the purpose, or if pledged as collateral security, or if deposited with one or more banks or trust companies, or with brokers who are members of a recognized security exchange, in safekeeping or custody accounts;

- the taking of any action by any such bank or trust company or broker, which is incidental to the rendering of safekeeping or custodian service to the corporation;

- the maintenance of an office in this state by one or more officers or directors of the corporation who are not employees of the corporation if the corporation otherwise is not doing business in this state, and does not employ capital or own or lease property in this state; or

- the keeping of books or records of a corporation in this state if such books and records are not kept by employees of the corporation and the corporation does not otherwise do business, employ capital, own or lease property, or maintain an office in this state.

See § 209.2.

Deriving receipts

A corporation is deriving receipts in this state if it has receipts within New York of $1.138 million or more in a tax year. See § 209.1 and TSB-M-21(3)C, Deriving Receipts Thresholds.

Receipts within this state means the receipts included in the numerator of the apportionment factor determined under § 210-A and reported in Part 3, line 55, column A.

Corporate partners

- If a partnership is doing business, employing capital, owning or leasing property, maintaining an office, or deriving receipts from activity, in New York State, then a corporation that is a general partner in that partnership is subject to tax under Article 9-A. See § 209.1(f).

- A foreign corporation is doing business, employing capital, owning or leasing property, maintaining an office, or deriving receipts from activity, in New York State, if it is a limited partner of a partnership (other than a portfolio investment partnership) that is doing business, employing capital, owning or leasing property, maintaining an office, or deriving receipts from activity, in New York State, and if it is engaged, directly or indirectly, in the participation or in the domination or control of all or any portion of the business activities or affairs of the partnership.

A limited liability company or limited liability partnership that is treated as a partnership for federal income tax purposes will be treated as a partnership for New York State tax purposes.

Determining economic nexus

For purposes of determining nexus, determine the $1.138 million threshold for deriving receipts by combining the general partner’s receipts in New York with the partnership’s receipts in New York. Also, when a limited partner is engaged, directly or indirectly, in the participation or in the domination or control of all or any portion of the business activities or affairs of the partnership, other than a portfolio investment partnership, for purposes of determining nexus, determine the $1.138 million threshold for deriving receipts by combining the limited partner’s receipts in New York with the partnership’s receipts in New York.

In instances where a limited liability company is treated as a partnership, other than a portfolio investment partnership:

- If the limited liability company’s operating agreement does not limit a corporate member’s participation in the management of the limited liability company, combine such member’s receipts in New York with the receipts in New York of the limited liability company.

- If the limited liability company’s operating agreement does limit a corporate member’s participation in the management of the limited liability company but such member is engaged, directly or indirectly, in the participation in or domination or control of all or any portion of the business activities or affairs of the limited liability company, combine such member’s receipts in New York with the receipts in New York of the limited liability company.

Example: Partnership A has two general partners: Partner B who owns 60% of the partnership and Partner C who owns 40%. Partnership A has $800,000 of receipts in New York. Separately, Partner B has $700,000 of receipts in New York and Partner C has $600,000 of receipts in New York. For purposes of determining nexus only, both partners B and C would be treated as having $800,000 from the partnership. Combined with their own receipts, both general partners exceed $1.138 million in receipts in New York ($1.5 million for Partner B and $1.4 million for Partner C). Therefore, both general partners are subject to tax.

A corporate partner (except for certain foreign corporate limited partners) must compute its tax with respect to its interest in the partnership under either the aggregate or entity method. Under the aggregate method, a corporate partner takes into account its distributive share of receipts, income, gain, loss or deduction, and its proportionate part of assets, liabilities and transactions from the partnership. Under the entity method, a corporate partner is treated as owning an interest in a partnership entity. The interest is considered an intangible asset that constitutes business capital. The aggregate method is the preferred method.

Qualified subchapter S subsidiary

In situations where the federal qualified subchapter S subsidiary treatment is followed for New York State purposes:

- the qualified subchapter S subsidiary is not considered a subsidiary of the parent corporation;

- the qualified subchapter S subsidiary is ignored as a separate taxable entity, and the assets, liabilities, income, and deductions of the qualified subchapter S subsidiary are included with the assets, liabilities, income, and deductions of the parent for franchise tax purposes;

- for other taxes, such as sales and excise taxes, the qualified subchapter S subsidiary continues to be recognized as a separate corporation.

Where the federal qualified subchapter S subsidiary treatment is not followed for New York State purposes, the combined reporting rules must still be applied to determine if either the parent, the qualified subchapter S subsidiary, or both should file as distinct members of a combined group on a Form CT-3-A, General Business Corporation Combined Franchise Tax Return.

Filing requirements for a qualified subchapter S subsidiary

Filing requirements for a qualified subchapter S subsidiary that is owned by a New York S corporation or a nontaxpayer corporation:

- Parent is a New York S corporation: New York State will follow the federal qualified subchapter S subsidiary treatment. The parent (with its qualified subchapter S subsidiary’s activity included) files as a New York S corporation on a Form CT-3-S.

- Nontaxpayer parent: New York State follows the federal qualified subchapter S subsidiary treatment where the qualified subchapter S subsidiary is a New York State taxpayer but the parent is not, if the parent elects to be taxed as a New York S corporation by filing Form CT-6, Election by a Federal S Corporation to be Treated As a New York S Corporation. The parent and qualified subchapter S subsidiary are taxed as a single New York S corporation, and file Form CT-3-S. If the parent does not elect to be a New York S corporation, the qualified subchapter S subsidiary (without its parent’s activity included) must file as a New York C corporation on a Form CT-3 or, if the combined filing requirements are met with one or more other entities (one of which could be the parent), on a Form CT-3-A. In this case, both the parent and the qualified subchapter S subsidiary, as separate entities, are subject to the combined reporting rules, and if the parent and qualified subchapter S subsidiary are unitary they both file as distinct members of a combined group on the same Form CT-3-A.

- Exception: excluded corporation: Notwithstanding the above rules, qualified subchapter S subsidiary treatment is not allowed when the parent and qualified subchapter S subsidiary file under different Articles of the Tax Law (or would file under different Articles if both were subject to New York State franchise tax); in this case, each corporation must file as a distinct entity under its applicable Article, subject to the Article 9-A or Article 33 combined reporting rules, as applicable.

New York State equivalents to federal Schedule K-1

- Form IT-204-IP, New York Partner’s Schedule K-1, is completed for each partner who is an individual, estate or trust, or partnership required to file under Tax Law Article 22 (Personal Income Tax).

- Form IT-204-CP, New York Corporate Partner’s Schedule K-1, is completed for each corporate partner that is taxable under Tax Law Article 9-A.

These forms give each partner its distributive share of income, deductions, New York modifications, credits, and other information the partner needs to complete the partner’s New York State personal income tax or corporation franchise tax return.

If you received a complete Form IT-204-CP from your partnership, see Form IT-204-CP-I, Partner’s Instructions for Form IT-204-CP, before completing your franchise tax return.

Other forms you may need to file

- Form CT-6.1, Termination of Election to be Treated as a New York S Corporation, must be filed to terminate New York S corporation status.

- Form CT-33-D, Tax on Premiums Paid or Payable to an Unauthorized Insurer, must be filed if you purchased or renewed a taxable insurance contract that covers risks located in New York State directly from an insurer not authorized to transact business in New York State. This return must be filed within 60 days following the end of the calendar quarter in which the contract was purchased or renewed. For more information, see Form CT-33-D.

- Form CT-60, Affiliated Entity Information Schedule You must file Form CT-60 if you are an Article 9-A taxpayer and you have included the activities of any of the following on your return:

- a qualified subchapter S subsidiary;

- a single member limited liability company; or

- a tax-exempt domestic international sales corporation.

You must also file Form CT-60 if:

-

- you are a partner in a partnership; or

- you have affiliated entities.

- Form CT-186-E, Telecommunications Tax Return and Utility Services Tax Return, must be filed by a corporation that provides telecommunication services. The corporation must pay an excise tax on its gross receipts from the sale of telecommunication services under Article 9, § 186-e.

- Form CT-222, Underpayment of Estimated Tax by a Corporation, is used to inform the Tax Department that the corporation meets one of the exceptions to reduce or eliminate the underpayment of estimated tax penalty pursuant to Tax Law, Article 27, § 1085(d).

- Form CT-223, Innovation Hot Spot Deduction, must be filed if you are a corporation that is a qualified entity located both inside and outside a hot spot, or you are a corporate partner of a qualified entity, or both.

- Form CT-225, New York State Modifications, must be filed if you are entering an amount on Form CT-34-SH, lines 3 and/or 5.

- Form CT-227, New York State Voluntary Contributions, must be filed if you choose to make a voluntary contribution to any of the available funds.

- Form CT-399, Depreciation Adjustment Schedule, must be filed to compute the allowable New York State depreciation deduction if you claim: 1) the federal accelerated cost recovery system (ACRS) depreciation or modified accelerated cost recovery system (MACRS) deduction for certain property placed in service after December 31, 1980, or 2) a federal special depreciation deduction for certain property described in IRC § 168(k)(2) placed in service on or after June 1, 2003, in tax years beginning after December 31, 2002. This form also contains schedules for determining a New York State gain or loss on the disposition of such properties.

- Form CT-400, Estimated Tax for Corporations, must be filed if your New York State franchise tax liability can reasonably be expected to exceed $1,000.

Most corporations are required to electronically file this form either using tax software or online, after setting up an online services account, through the department’s website.

- Form DTF-664, Tax Shelter Disclosure for Material Advisors, assists material advisors in complying with New York State’s disclosure requirements.

- Form DTF-686, Tax Shelter Reportable Transactions Attachment to New York State Return, assists taxpayers and persons in complying with New York State’s disclosure requirements.

- Form IT-2658, Report of Estimated Tax for Nonresident Individual Partners and Shareholders, must be filed by a New York S corporation that is required to pay estimated tax on behalf of a shareholder who is a nonresident individual.

- Form IT-2659, Estimated Tax Penalties for Partnerships and New York S Corporations, determines if estimated tax has been underpaid on behalf of a shareholder who is a nonresident individual. Form IT-2659 also computes the penalty if the estimated tax has been underpaid.

When to file

File your return within 2½ months after the end of your reporting period. If you are reporting for the calendar year, your return is due on or before March 15. If your filing date falls on a Saturday, Sunday, or legal holiday, then you must file your return on or before the next business day. See Non business days - legal holidays (search: holidays).

How to request an extension of time to file

If you cannot meet the filing deadline, file Form CT-5.4, Request for Six-Month Extension to File New York S Corporation Franchise Tax Return, and pay the properly estimated franchise tax on or before the original due date of the return. Additional extension of time to file Form CT-3-S will not be granted beyond six months.

Most corporations are required to request their extension electronically. You may use approved commercial software or request your extension using your Business Online Services account. For a list of forms you may Web File through your account, see File a corporation tax extension.

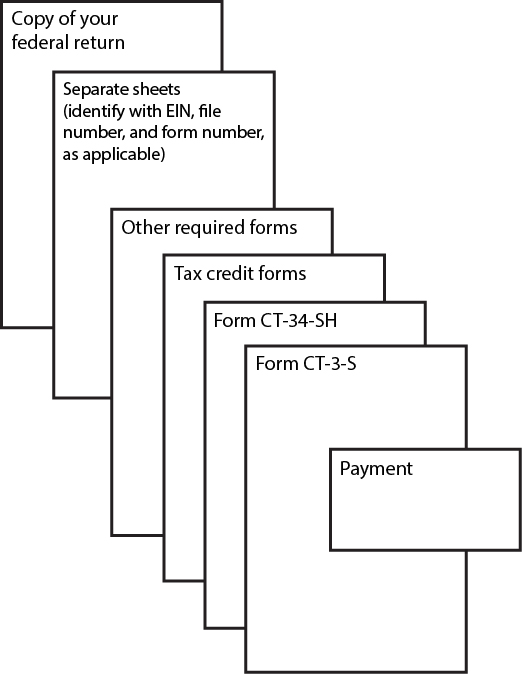

How to file

Electronically

See Approved software developers for corporation tax e-file.

By mail

NYS CORPORATION TAXPO BOX 15182ALBANY NY 12212-5182Private delivery services: See Publication 55, Designated Private Delivery Services.

Penalties and interest

If you pay after the due date

If you do not pay the tax due on or before the original due date, you must pay interest on the amount of underpayment from the original due date (without regard to an extension of time for filing) of the return to the date the tax is paid. Exclude from the interest computation any amount representing the first installment of estimated tax for next period. Interest is always due, without any exceptions, on any underpayment of tax. An extension of time for filing does not extend the due date for payment of tax.

If you file and pay after the due date

Compute additional charges for late filing and late payment on the amount of tax minus any payment made on or before the due date (with regard to any extension of time for filing). Exclude from the penalty computation any amount representing the first installment of estimated tax for the next period.

- If you do not file a return when due or if the request for extension is invalid, add to the tax 5% per month, up to a total of 25%. See § 1085(a)(1)(A).

- If you do not file a return within 60 days of the due date, the additional charge in item A cannot be less than the smaller of $100 or 100% of the amount required to be shown as tax. See §1085(a)(1)(B).

- If you do not pay the tax shown on a return, add to the tax ½% per month, up to a total of 25%. See § 1085(a)(2).

- The total of the additional charges in items A and C may not exceed 5% for any one month except as provided for in item B. See § 1085(a).

If you think you are not liable for these additional charges, attach a statement to the return explaining the delay in filing, payment, or both. See § 1085.

Note: You may calculate your penalty and interest online, or you may call and we will compute the penalty and interest for you (see Need help? in Form CT-1).

If you understate your tax

If the tax you report is understated by 10% or $5,000, whichever is greater, you will have to pay a penalty of 10% of the amount of understated tax. You can reduce the amount on which you pay penalty by subtracting any item for which there is or was substantial authority for the way you treated it, or there is adequate disclosure on the return or in an attached statement.

See § 1085(k).

If you underpay your estimated tax

If you can reasonably expect your New York State franchise tax liability to exceed $1,000, you must make payments of estimated tax. A penalty will be imposed if you fail to file a declaration of estimated tax or fail to pay the entire installment payment of estimated tax due. For complete details, see Form CT-222.

If you fail to pay estimated tax on behalf of a shareholder

If the New York S corporation is required to pay estimated tax and fails to pay estimated tax on behalf of a shareholder, a penalty of $50 per shareholder for each failure to pay may be imposed. The penalty may be waived if it is shown that the failure is due to reasonable cause and not due to willful neglect.

If you underpay estimated tax on behalf of a shareholder

A New York S corporation may be subject to the underpayment of estimated tax penalty. For complete details, see Form IT-2659.

If you fail to provide shareholder information

If you do not file Form CT-3-S on time, or you fail to provide the shareholder information required (all items of income, loss, deduction, and other pertinent information), you will have to pay a penalty. The penalty is $50 per shareholder per month or fraction of a month, up to a total of $250 per shareholder. See Article 22 § 685(h)(2). You will also have to pay an additional penalty of $50 for each shareholder whose Social Security number you do not show. See § 685(k). All shareholders of the S corporation during any part of the tax year must be counted. These penalties may be waived if it is shown that the failure is due to reasonable cause and not due to willful neglect.

Other penalties

Strong civil and criminal penalties may be imposed for negligence or fraud.

Amended returns

If you are filing an amended return for any purpose, mark an X in the Amended return box on page 1 of the return.

If you file an amended federal return, you must file an amended New York State return within 90 days thereafter.

Important: Use the correct year’s form for the tax year you are amending. If you file an amended return using a form for the wrong tax year:

- we may reject your amended return, and

- it may delay any tax benefits you are claiming.

For amended returns based on changes to federal taxable income

If your federal taxable income has been changed or corrected by a final determination of the Commissioner of Internal Revenue, or by renegotiation of a contract or subcontract with the United States, you must file an amended return reflecting the change to federal taxable income within 90 days of the final federal determination (as final determination is described under the regulations of the Commissioner of Taxation and Finance).

You must attach a copy of federal Form 4549, Income Tax Examination Changes, to your amended return.

If you filed as part of a consolidated group for federal tax purposes but on a separate basis for New York State tax purposes, you must submit a statement indicating the changes that would have been made if you had filed on a separate basis for federal tax purposes.

For credits or refunds of corporation tax paid

To claim any refund type that requires an amended return, file an amended New York State return for the year being amended and, if applicable, attach a copy of the claim form filed with the IRS and proof of federal refund approval, Statement of Adjustment to Your Account. Be sure to use the tax return for the year being amended.

Federal S corporations must file an amended New York State return for the year being amended. If applicable, attach a copy of the amended federal Form 1120S. Every shareholder of the electing New York S corporation must file an amended return on a designated New York State individual, estate, or trust return.

You must file the amended return within three years of the date the original return was filed or within two years of the date the tax was paid, whichever is later. If you did not file an original return, you must make the request within two years of the date the tax was paid. However, a claim for credit or refund based on a federal change must be filed within two years from the time the amended return reporting the change or correction was required to be filed (see For amended returns based on changes to federal taxable income). For additional limitations on credits or refunds, see § 1087.

Filing your final return

If the corporation is any of the following, mark an X in the Final return box on page 1 of your return:

- a domestic corporation that ceased doing business, employing capital, owning or leasing property, or deriving receipts from activity, in New York State during the tax year and wishes to dissolve; or

- a foreign corporation that is no longer subject to the franchise tax in New York State.

Do not mark an X in the Final return box:

- if you are only changing the type of return that you file (for example, from Form CT-3-S to CT-3), or

- in the case of a merger or consolidation.

Include the full profit from any installment sale made in your final tax year in your final return. Also include in your final return any remaining profit not yet received from a prior year’s installment sale.

For information on voluntary dissolution and surrender of authority, see Instructions for voluntary dissolution of a New York corporation (search: dissolution) and Instructions for surrender of authority by foreign business corporation (search: surrender).

New York S corporation termination year

The New York S election can terminate on a day other than the first day of the tax year, whether or not the federal S election terminates at the same time. In either case, the tax year is divided into two tax periods (an S short year and a C short year). The corporation must file Form CT-3-S for the S short year. For the C short year, the corporation must file Form CT-3. The due date of the S short year return is the same as the New York C short year return.

When an IRC § 338(h)(10) election is made for a target corporation that is a New York S corporation, the target corporation must file two short period reports. When filing the second short period report, the federal taxable income of the new target is the starting point for computing entire net income.

If the federal and New York S elections terminate at the same time, entire net income assigned to Form CT-3 for the C short year is determined using the same method of accounting as used for federal income tax purposes; that is, daily pro rata allocation under IRC §1362(e)(2) or normal tax accounting rules under IRC § 1362(e)(3).

If the federal S election continues but the New York S election terminates, use normal tax accounting rules under IRC § 1362(e)(3) if either of the following applies:

- all persons who are shareholders in the corporation at any time during the New York S short year and all persons who are shareholders in the corporation on the first day of the New York C short year consent to such election; or

- there is a sale or exchange of 50% or more of the stock in the corporation during the year.

Otherwise, use the daily pro rata allocation method under IRC § 1362(e)(2).

To indicate which method of accounting the New York S corporation elected for the New York S short year and subsequent New York C short year, mark an X in the appropriate line H box on Form CT-3-S, page 1.

The total tax for the New York S short year and New York C short year may not be less than the fixed dollar minimum tax determined as if the corporation were a C corporation for the entire year.

Reporting period

Use this tax return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023.

You can also use the 2022 return if:

- you have a tax year of less than 12 months that begins and ends in 2023, and

- the 2023 return is not yet available at the time you are required to file the return.

In this case you must show your 2023 tax year on the 2022 return and take into account any tax law changes that are effective for tax years beginning after December 31, 2022.

All filers must complete the beginning and ending tax year information in your approved corporation tax software. If you are not subject to the e-file mandate for businesses and you are filing a paper return, complete the tax year boxes in the upper-right corner on page 1 of the form.

Taxpayers using a 52-53 week year

If you report on the basis of a 52-53 week accounting period for federal income tax purposes, you may report on the same basis for Article 9-A purposes. If a 52-53 week accounting period begins within seven days from the first day of any calendar month, the tax year is deemed to begin on the first day of that calendar month. If a 52-53 week accounting period ends within seven days from the last day of any calendar month, the tax period will be deemed to end on the last day of the calendar month.

Computing corporation franchise tax

New York S corporations taxable under Article 9-A are required to pay the fixed dollar minimum tax imposed under § 210.1(d).

Fixed dollar minimum tax schedule

A domestic corporation that is no longer doing business, employing capital, owning or leasing property, or deriving receipts from activity, in New York State is exempt from the fixed dollar minimum tax for years following its final tax year and is no longer required to file a franchise tax return provided it meets the requirements listed in § 209.8.

Fixed dollar minimum tax for all New York S corporations (except qualified New York manufacturers or qualified emerging technology companies)

| New York receipts of: | Fixed dollar minimum tax equals: |

|---|---|

| Not more than $100,000 | $25 |

| More than $100,000 but not over $250,000 | $50 |

| More than $250,000 but not over $500,000 | $175 |

| More than $500,000 but not over $1,000,000 | $300 |

| More than $1,000,000 but not over $5,000,000 | $1,000 |

| More than $5,000,000 but not over $25,000,000 | $3,000 |

| Over $25,000,000 | $4,500 |

Fixed dollar minimum for New York S corporations that are qualified New York manufacturers or qualified emerging technology companies

| New York receipts of | Fixed dollar minimum tax equals: |

|---|---|

| Not more than $100,000 | $19 |

| More than $100,000 but not over $250,000 | $38 |

| More than $250,000 but not over $500,000 | $131 |

| More than $500,000 but not over $1,000,000 | $225 |

| More than $1,000,000 but not over $5,000,000 | $750 |

| More than $5,000,000 but not over $25,000,000 | $2,250 |

| Over $25,000,000 | $3,375 |

Short periods

If a short period (a tax period of less than 12 months), compute the New York receipts by dividing the amount of the receipts by the total number of months in the short period and multiplying the result by 12.

The fixed dollar minimum tax may be reduced for short periods as follows:

| Period | Reduction |

|---|---|

| Not more than six months | 50% |

| More than six months but not more than nine months | 25% |

| Over nine months | none |

Computing tax for corporate partners

A taxpayer that is subject to tax under Article 9-A and is a partner in a partnership (a corporate partner) computes its tax for its interest in the partnership using either the aggregate method or entity method, whichever applies. For an exception to these methods, see Election by a foreign corporate limited partner.

Aggregate method

Under the aggregate method, a corporate partner is viewed as having an undivided interest in the partnership’s assets, liabilities, and items of receipts, income, gain, loss and deduction. The partner is treated as participating in the partnership’s transactions and activities.

Corporate partners required to file under the aggregate method

A corporate partner receiving a complete Form IT-204-CP, New York Corporate Partner’s Schedule K-1, must file using the aggregate method. In addition, a corporate partner must file using the aggregate method if the corporate partner has access to the information necessary to compute its tax using the aggregate method. A corporate partner is presumed to have access to the information and therefore is required to file using the aggregate method if it meets one or more of the following conditions:

- it is conducting a unitary business with the partnership;

- it is a general partner of the partnership or is a managing member of a limited liability company which is treated as a partnership for federal income tax purposes;

- it has a 5% or more interest in the partnership;

- it has reported information from the partnership in a prior tax year using the aggregate method;

- its partnership interest constitutes more than 50% of its total assets;

- its basis in its interest in the partnership determined under IRC § 705 on the last day of the partnership year that ends within or with the taxpayer’s tax year is more than $5,000,000; or

- any member of its affiliated group has the information necessary to perform such computation.

Note: An affiliated group has the same meaning as defined in IRC § 1504 without regard to the exclusions provided for in § 1504(b). However, the term common parent corporation is deemed to mean any person as defined in IRC § 7701(a)(1).

Computation of tax under the aggregate method

Include the taxpayer’s distributive share (see IRC § 704) of each partnership item of receipts, income, gain, loss, and deduction and the taxpayer’s proportionate part of each partnership asset, liability, and partnership activity in the computation of the taxpayer’s fixed dollar minimum tax. These items have the same source and character in the hands of the partner for Article 9-A purposes that the items have for the partner for federal income tax purposes.

Entity method

Under the entity method, a partnership is treated as a separate entity and a corporate partner is treated as owning an interest in the partnership entity. The partner’s interest is an intangible asset that is classified as business capital.

A corporate partner that does not receive a complete Form IT-204-CP may file using the entity method only if it does not meet any of the conditions listed above and does not have access (and will not have access within the time period allowed for filing a return with regard to all extensions of time to file) to the information necessary to compute its tax using the aggregate method and certifies these facts to the commissioner.

Computation of tax for an electing foreign corporate limited partner: Separate accounting election

A foreign corporation that is a limited partner in, and that is engaged, directly or indirectly, in the participation or in the domination or control of all or any portion of the business activities of one or more limited partnerships where such partnerships are doing business, employing capital, owning or leasing property, maintaining an office, or deriving receipts from activity, in New York State, is subject to tax under Article 9-A.

When this is the sole reason the foreign corporation is taxable under Article 9-A, and such corporation does not file on a combined basis, such corporation may elect to compute its tax by taking into account only its distributive share of each partnership item of receipts, income, gain, loss, and deduction (including any modifications), and its proportionate part of each asset, liability, and partnership activity of the limited partnership (the separate accounting election).

Exceptions

- A partnership may be required to file a New York State partnership return, but is not doing business, employing capital, owning or leasing property, maintaining an office, or deriving receipts from activity, in New York State, (for example, when the partnership has a New York State partnership return filing requirement only because it has a New York State resident partner that is an individual, estate, or trust). In that case, having an interest in that partnership would not subject a foreign corporate limited partner to tax under Article 9-A, and the separate accounting election would not be applicable with respect to that partnership.

- If the limited partnership and corporate group are engaged in a unitary business, wherever conducted, the corporation may not make this election.

Corporate group means the corporate limited partner itself or, if it is a member of an affiliated group, the corporate limited partner and all other members of such affiliated group.

How to make the separate accounting election

For its tax years beginning on or after January 1, 2017, the foreign corporate limited partner must make the separate accounting election as follows:

- Complete Form CT-60, Affiliated Entity Information Schedule, in Schedule B, Part 3.

- Sign the form.

- File Form CT-60 with Form CT-3-S.

This election:

- cannot be revoked, and

- is binding with respect to that partnership interest for all future tax years.

How to complete Form CT-3-S when the separate accounting election is made

When you compute your tax base and business apportionment factor, use only your distributive share or proportionate part of receipts, net income, net gains, activities and other items of such limited partnership.

Do not report any of your own items of receipts, net income, net gains, and other items.

In this situation, report only your distributive share of receipts, net income, net gains, and other items (including all income and loss not computed separately, and all separately stated items of income and loss), flowing through to you from such limited partnership, on your Form CT-3-S, Part 3, and use that distributive share to compute your business apportionment factor, and to compute your New York State receipts amount used to determine your fixed dollar minimum tax on Form CT-3-S, Part 2.

General information and line instructions

When you complete Form CT-3-S, Part 3, include all receipts, net income, net gains, and other items flowing through to you from such limited partnership (including income and loss not computed separately, and separately stated items of income and loss), even if there are amounts that would have qualified as investment income or other exempt income under § 208 for an Article 9-A, New York C corporation filer. Include all such receipts, net income, net gains, and other items in the business apportionment fraction in accordance with Article 9-A sourcing rules. See § 210-A and the applicable regulations.

When the separate accounting election is in effect, do not take into account any gain or loss that is recognized from the sale of the interest in the limited partnership for which the election was made.

Special circumstances

The separate accounting election is in effect and you do not have access to all of the necessary information to properly complete Form CT-3-S.

If you have made the separate accounting election with respect to a limited partnership, and you do not have access to the information necessary to compute your fixed dollar minimum tax base and business apportionment factor as discussed above, you must:

- report a business apportionment factor of 100% by reporting on line 55 of Form CT-3-S, Part 3, a New York State receipts amount (column A) equal to your distributive share of such limited partnership’s Everywhere receipts amount (column B), then

- compute your fixed dollar minimum tax on Form CT-3-S, Part 2, using that New York State receipts amount.

The separate accounting election is in effect for multiple limited partnership interests and you have no limited partnership interests for which the election has not been made.

If this circumstance applies, complete:

- the front page of Form CT-3-S, leaving line C blank;

- page 2 making sure to mark an X in the box on line O;

- all of Part 1 (Federal Form 1120S information); and

- Part 2 (Computation of tax) as follows:

- Complete an individual pro forma Form CT-3-S, Part 3, for each limited partnership for which the election was made. Complete these lines using only your distributive share of the limited partnership’s receipts, net income, net gains, and other items, that must be included in the numerator and denominator of the business apportionment fraction (see § 210-A and the applicable regulations).

- Add all pro forma Form CT-3-S, Part 3, line 55, column A amounts.

- Enter the result on Part 2, line 22, of the Form CT-3-S you file with New York State.

- Complete the remaining lines of Part 2, and all the applicable lines on page 6, of the Form CT-3-S you file with New York State.

- Leave Part 3 (Computation of business apportionment factor) blank on the Form CT-3-S that will be filed with New York State. Do not make any entries.

- File all pro forma Forms CT-3-S with the Form CT-3-S you file with New York State.

The corporation must report to each shareholder the business apportionment factor computed for each limited partnership for which the separate accounting election is in effect, as shown on the pro forma Forms CT-3-S, Part 3, line 56, as well as the shareholder’s distributive share of each separately and nonseparately stated item of income and loss from each such partnership.

How to fill out your tax return

Important identifying information

For us to process your corporation tax forms, we need your necessary identifying information. Include your employer identification number and file number on each corporation tax form filed and keep a record of that information for future use.

If you use a paid preparer or accounting firm, make sure they use your complete and accurate identifying information when completing all forms prepared for you.

Signature

The return must be certified by the president, vice president, treasurer, assistant treasurer, chief accounting officer, or other officer authorized by the taxpayer corporation.

The return of an association, publicly traded partnership, or business conducted by a trustee or trustees must be signed by a person authorized to act for the association, publicly traded partnership, or business.

If an outside individual or firm prepared the return, all applicable entries in the paid preparer section must be completed, including identification numbers (see Paid preparer identification numbers in Form CT-1). If you fail to sign the return, any refund you are owed will be delayed and it may result in penalties.

Line instructions

Line A

Make your check or money order payable in United States funds. We will accept a foreign check or foreign money order only if payable through a United States bank or if marked Payable in U.S. funds.

Line J

If you are claiming qualified New York manufacturer or qualified emerging technology company status for purposes of a lower fixed dollar minimum tax, mark an X in the applicable box.

The principally engaged test

A corporation is a qualified New York manufacturer if during the tax year the taxpayer is principally engaged in the production of goods by:

- manufacturing,

- processing,

- assembling,

- refining,

- mining,

- extracting,

- farming,

- agriculture,

- horticulture,

- floriculture,

- viticulture, or

- commercial fishing.

A taxpayer is principally engaged in the foregoing activities if, during the tax year, more than 50% of its gross receipts are derived from receipts for the sale of goods produced by these activities.

In addition, a taxpayer that does not satisfy the principally engaged test may be a qualified New York manufacturer if the taxpayer employs during the tax year at least 2,500 employees in manufacturing in New York and the taxpayer has property in the state used in manufacturing, the adjusted basis of which for New York State tax purposes (see TSB-M-19(5)C, New York State Adjusted Basis for Qualified New York Manufacturers) at the close of the tax year is at least $100 million.

The following are not considered qualifying activities for purposes of the principally engaged test, or for purposes of determining if employees are employed in manufacturing, or if property is used in manufacturing:

- the generation of and distribution of electricity

- the distribution of natural gas

- the production of steam associated with the generation of electricity

Any amount of global intangible low-taxed income included in federal taxable income is disregarded for purposes of the principally engaged test used to determine a taxpayer’s eligibility for preferential rates and amounts available to manufacturers.

- A qualified New York manufacturer is a manufacturer that has property in New York State that is principally used by the taxpayer in the production of goods by manufacturing, processing, assembling, refining, mining, extracting, farming, agriculture, horticulture, floriculture, viticulture, or commercial fishing, and either:

- the New York adjusted basis of the property is at least $1 million at the close of the tax year (see TSB-M-19(5)C); or

- all of its real and personal property is located in New York State.

- A QETC is a qualified emerging technology company as defined under Public Authorities Law 3102-e(1)c, without regard to the $10 million limitation.

Part 2: Computation of tax

Important: To avoid an incorrect assessment or a delay of your refund, you must enter an amount on line 22, New York receipts. If you do not have receipts, enter 0 on line 22.

Line 22: New York receipts

Include the total receipts included in the numerator of the apportionment factor from Part 3, line 55, column A (New York State). For a short period, annualize such receipts by dividing by the number of months in the short period and multiplying the result by 12.

Line 23: Fixed dollar minimum tax

The fixed dollar minimum tax is determined by your New York receipts. To determine the applicable fixed dollar minimum tax, see Fixed dollar minimum tax schedule. Qualified New York manufacturers and qualified emerging technology companies must also mark an X in the applicable box on line J. The fixed dollar minimum tax may be reduced for short periods. See instructions under the fixed dollar minimum tax tables for the appropriate reduction for short periods.

Line 24: Recapture of tax credits

If you claimed any New York State tax credits for any tax year prior to becoming a New York S corporation, and the Tax Law requires recapture of some or all of the credit, under stated conditions, then the tax credit must be recaptured in the year required even when the year is a New York S year. Use the appropriate credit form to compute the recaptured tax credits.

Line 26: Special additional mortgage recording tax credit

Enter the amount of nonrefundable special additional mortgage recording tax credit from Form CT-43, Claim for Special Additional Mortgage Recording Tax Credit, line 9, and any deferred nonrefundable special additional mortgage recording tax credit from Form CT-501, Temporary Deferral Nonrefundable Payout Credit, line 7. The special additional mortgage recording tax credit cannot reduce your tax liability below the amount of your fixed dollar minimum tax.

Composition of prepayments

If you need additional space, enter see attached in this section and attach all relevant prepayment information.

Line 37: Overpayment credited from prior years

Include overpayment credited from prior years. You may also include, from last year’s return, any amount of refundable special additional mortgage recording tax credit you chose to be credited as an overpayment.

Line 40: Estimated tax penalty

To inform the Tax Department that the corporation meets one of the exceptions to reduce or eliminate the underpayment of estimated tax penalty pursuant to §1085(d), file Form CT-222.

Lines 41 and 42

If you are not filing this return on time, you must pay interest and additional charges. See Penalties and interest.

Line 47: Overpayments

If you have overpaid your tax, you will not automatically receive a refund. Instead, we will credit your overpayment to the following tax year unless you indicate a refund on line 49. We will notify you that the overpayment has been credited and explain how to request a refund of the credited amount. If you choose to request a refund of such credited amount, you must claim a refund of such overpayment prior to the original due date of the following year’s return.

Lines 48 and 49

You may apply an overpayment as a credit to your next state franchise tax period or you may have it refunded. Indicate on lines 48 and 49 the amount of overpayment you wish to be credited or refunded.

Line 50: Refund of unused special additional mortgage recording tax credit

Enter the amount of refundable special additional mortgage recording tax credit from Form CT-43, Claim for Special Additional Mortgage Recording Tax Credit, line 13. Do not include on this line any amount of special additional mortgage recording tax credit shown on Form CT-43, line 9, or Form CT-501, line 7.

Part 3: Computation of business apportionment factor

Include all receipts, net income (not less than zero), net gains (not less than zero), and other items you reported on your federal Form 1120S, Schedule K (including income and loss not computed separately, and separately stated items of income and loss), even if there are amounts that would have qualified as investment income or other exempt income for an Article 9-A New York C corporation filer under § 208. Include all such receipts, net income, net gains, and other items in the apportionment fraction (see the rules in § 210-A and the applicable regulations).

Note: Generally, you should report receipts from services on line 53 (Receipts from other services/activities not specified).

You must complete the computation of the business apportionment factor section, even if your business apportionment factor is 100%, to report the computation of the New York State receipts used to determine your fixed dollar minimum tax.

Nonresident and part-year resident shareholders of a New York S corporation need the business apportionment factor to determine their New York State source income pursuant to § 632(a)(2) and TSB-M-15(7)C, (6)I, Impact of New York State Corporate Tax Reform on New York S Corporations and their Nonresident and Part-Year Resident Shareholders.

Columns A and B

In this section, we provide specific instructions for column A (New York State column) and column B (Everywhere column) as follows:

- New York State column: Refer to the specific line instructions to determine New York State amounts and enter those amounts in column A for each line.

- Everywhere column: Enter 100% of the amount of the item you report on a line in column B, unless otherwise specified.

If only one line of Part 3 applies to your business, you must still complete both columns for that line. Skip a line only if both the numerator (column A) and the denominator (column B) are zero.

If you have no receipts (see Examples) required to be included in the denominator of the apportionment factor, mark the box at the beginning of Form CT-3-S, Part 3, Computation of business apportionment factor.

Note: If you have any other Everywhere receipts, this box does not apply. If you mark the box, you must attach a statement explaining why you have no receipts required to be included in the business apportionment factor.

Examples: Taxpayers that own property in New York State but have no federal taxable income, effectively connected income, or receipts from the rental, sale, or lease of such property amounts, or taxpayers whose only income is dividends and net gains from the sales of stock or sales of partnership interests when the fixed percentage election is not made.

Section 210-A.2: Sales of tangible personal property, electricity and net gains from real property

Line 1

New York State column: Include receipts from the sale of tangible personal property when shipments are made to points in the state, or the destination of the property is a point in the state.

Include receipts from sales of tangible personal property and electricity that are traded as commodities, as defined in IRC section 475, on line 27.

Line 2

New York State column: Include receipts from the sale of electricity when delivered to points in the state.

Include receipts from sales of tangible personal property and electricity that are traded as commodities, as defined in IRC § 475, on line 27.

Line 3

New York State column: Net the gains from the sales of real property located within the state against the losses from the sales of real property located within the state and enter the result (but not less than zero).

Everywhere column: Net the gains from the sales of real property located everywhere against the losses from the sales of real property located everywhere and enter the result (but not less than zero).

Section 210-A.3: Rentals of real and tangible personal property, royalties, and rights for certain closed-circuit and cable TV transmissions

Line 4

New York State column: Include receipts from rentals of real and tangible personal property located within the state.

Line 5

New York State column: Include receipts of royalties from the use of patents, copyrights, trademarks, and similar intangible personal property within the state.

Line 6

New York State column: Include receipts from the sales of rights for closed-circuit and cable television transmissions of an event (other than events occurring on a regularly scheduled basis) taking place within the state as a result of the rendition of services by employees of the corporation, as athletes, entertainers, or performing artists, to the extent that those receipts are attributable to those transmissions received or exhibited within the state.

Section 210-A.4: Receipts from sale of, license to use, or granting of remote access to digital products

Line 7

Digital products

For Article 9-A apportionment purposes, the term digital product generally means any property or service, or combination thereof, of whatever nature delivered to the purchaser through the use of wire, cable, fiber-optic, laser, microwave, radio wave, satellite or similar successor media, or any combination of these. It does not include legal, medical, accounting, architectural, research, analytical, engineering, or consulting services.

If the receipt for a digital product is comprised of a combination of digital property and services, it cannot be divided into separate components and is considered one receipt sourced under the appropriate method below regardless of whether it is separately stated for billing purposes.

New York State column: Apply the following methods in the order presented below to determine the amount of receipts to enter. You must exercise due diligence under each method to obtain the information necessary to source these receipts under a method before rejecting it and proceeding to the next method. The determination must be based on information known to the taxpayer or information that would be known to the taxpayer upon reasonable inquiry.

- the customer’s primary use location of the digital product

- the location where the digital product is received by the customer or is received by a person designated for receipt by the customer

- the apportionment fraction for the preceding tax year for such digital product

- the apportionment fraction in the current tax year for those digital products that can be sourced using the methods in items 1 and 2

Note: Item 3 does not apply to your first tax period you are subject to Article 9-A.

Section 210-A.5(a)1: Qualified financial instruments (qualified financial instruments), the 8% fixed percentage method

Line 8

A qualified financial instrument means a financial instrument of the following types that is marked to market in the tax year by the taxpayer under IRC § 475 or 1256:

- type A instruments under clause (A) (loans): reported on lines 11 and 12

- type B instruments under clause (B) (federal, state, and municipal debt): reported on lines 13 through 18

- type C instruments under clause (C) (asset-backed securities and other government agency debt): reported on lines 19, 20, and 21

- type D instruments under clause (D) (corporate bonds): reported on lines 22, 23, and 24

- type I instruments under clause (I) (physical commodities): reported on line 27

- type H, instruments under clause (H) (other financial instruments): reported on lines 29 and 30

- type G, instruments under clause (G) (stock or partnership interests): also reported on line 30

If the only loans that are marked to market under IRC § 475 or 1256 are loans secured by real property, then no loans are qualified financial instruments.

Types A, B, C, D, and I

If you have marked to market a financial instrument within types A, B, C, D, and I in the tax year, then any financial instrument within that same type that you have not marked to market under IRC § 475 or 1256 is also a qualified financial instrument in the tax year.

Types G and H

When a financial instrument within type H or type G is marked to market, not all financial instruments within type H or G are qualified financial instruments, as explained further below.

When reporting interest from other financial instruments on line 29, and net gains and other income from other financial instruments on line 30, marking to market one other financial instrument does not necessarily cause all other financial instruments to be qualified financial instruments. You must determine separately for each instrument whether other financial instruments are of the same type. Thus, you may report more than one type of other financial instruments on either of lines 29 and 30, and some types may be qualified financial instruments while other types may not be qualified financial instruments.

You may use line 30 to report financial instruments under § 210-A.5(a)(2), clause (G), or clause (H), or both.

Use line 30 to report financial instruments under clause (G) only when the financial instrument is a qualified financial instrument and the 8% fixed percentage method has been elected.

Determining whether a type G or H financial instrument is a qualified financial instrument

When any stock has been marked to market, all stock is a qualified financial instrument.

When any partnership interest in a widely held or publicly traded partnership has been marked to market, all partnership interests in a widely held or publicly traded partnership are qualified financial instruments.

Marking to market a financial instrument of the type under clause (G) does not cause financial instruments of the type under clause (H) to be qualified financial instruments. The same is true in regard to clause (H) in respect to clause (G). Therefore:

- Marking to market stock does not cause partnership interests in a widely held or publicly traded partnership that are not marked to market to be qualified financial instruments.

- Marking to market of partnership interests in a widely held or publicly traded partnership does not cause stock that is not marked to market to be qualified financial instruments.

- When a financial instrument falling under clause (H) has been marked to market, it does not necessarily cause all financial instruments under clause (H) to be qualified financial instruments. It is an instrument by instrument determination as to when instruments under clause (H) are of the same type. Thus, you may have more than one type of other financial instruments under clause (H) to report on line 30.

Electing the 8% fixed percentage method

You may elect to use the 8% fixed percentage method to apportion business receipts from qualified financial instruments. This election is irrevocable, applies to all qualified financial instruments, and must be made on an annual basis on the original timely filed return (determined with regard to valid extensions of time for filing) by marking an X in the box on line 8. If you do not mark the box but still apportion qualified financial instrument receipts by 8%, you will be considered to have made the election and to have marked the box.

Whether or not the 8% fixed percentage method is elected, when any financial instrument has been marked to market that is described on:

- either line 11 or 12, then the boxes on both lines 11 and 12 must be marked, and all financial instruments reported on such lines are qualified financial instruments (Type A financial instruments);

- any of lines 13 through 18, then the box above line 13 must be marked, and all financial instruments reported on such lines are qualified financial instruments (Type B financial instruments);

- any of lines 19 through 21, then the box above line 19 must be marked, and all financial instruments reported on such lines are qualified financial instruments (Type C financial instruments);

- any of lines 22 through 24, then the box above line 22 must be marked, and all financial instruments reported on such lines are qualified financial instruments (Type D financial instruments);

- line 27, then the box above line 27 must be marked, and all financial instruments reported on line 27 are qualified financial instruments (Type I financial instruments);

- line 28, then the box above line 28 must be marked;

- line 29, then the box above line 29 must be marked;

- line 30, due to clause (H), then the § 210-A.5(a)(2)(H) box above line 30 must be marked; and

- line 30, due to clause (G), then the § 210-A.5(a)(2)(G) box above line 30 must be marked

A marked qualified financial instrument box does not indicate which method of sourcing (8% fixed percentage method or customer-based sourcing rule) is being used to apportion such instruments. Also, because you may report more than one type of financial instrument on lines 28, 29, and 30, when the qualified financial instrument box above line 28 is marked, or one of the boxes above lines 29 and 30 is marked:

- in the case of line 28, it does not indicate that all financial instruments being reported on line 28 are qualified financial instruments, and

- in the case of lines 29 and 30 it does not indicate that all financial instruments being reported on lines 29 and 30 are qualified financial instruments.

General lines 9 through 53 instructions

For all financial instruments that do not meet the definition of a qualified financial instrument, or for instruments that meet the definition of a qualified financial instrument where the 8% fixed percentage method election is not in effect, use the customer-based sourcing rules as detailed in the specific line instructions for lines 9 through 27, 29, and 30.

Use worksheets A, B, and C of these instructions to compute certain amounts for lines 10, 12, 21, 24, 28, and 30 of Part 3, whether or not you elected to use the 8% fixed percentage method.

For purposes of these apportionment instructions, an individual is deemed to be located in New York State if the billing address is in the state. A business entity is deemed to be located in New York State if its commercial domicile is located in the state.

Use the following methods, in order, to determine the commercial domicile of a business entity, based on known information, or information that would be known upon reasonable inquiry:

- the seat of management and control of the business entity

- the billing address of the business entity in the taxpayer’s records

You must exercise due diligence before rejecting the first method and proceeding to the second method.

For purposes of these apportionment instructions, registered securities broker or dealer means a broker or dealer registered as such by the Securities and Exchange Commission or a broker or dealer registered as such by the Commodities Futures Trading Commission and includes an over-the-counter derivatives dealer as defined under regulations of the Securities and Exchange Commission (17 CFR 240.3b-12).

Section 210-A.5(a)(2)(A): Loans

A loan is secured by real property if 50% or more of the value of the collateral used to secure the loan (when valued at fair market value as of the time the loan was originated) consists of real property.

Line 9

New York State column: Include interest from loans secured by real property located within the state.

Everywhere column: Include interest from loans secured by real property located anywhere.

Line 10

New York State column: Multiply the amount of net gains (not less than zero) from sales of loans secured by real property by a fraction, the numerator of which is the amount of gross proceeds from sales of loans secured by real property located within the state, and the denominator of which is the amount of gross proceeds from sales of such loans everywhere.

Everywhere column: Include the amount of net gains (not less than zero) from sales of loans secured by real property both within and outside New York State.

Use Worksheet A.

Line 11

When the 8% fixed percentage method is elected (the box on Part 3, line 8, is marked), and the qualified financial instrument box on line 11 is marked, use that method for all financial instruments to be reported on this line.

Otherwise, use the customer-based sourcing rule below for all financial instruments to be reported on this line.

New York State column: Include interest from loans not secured by real property if the borrower is located in New York State.

Everywhere column: Include interest from all loans not secured by real property.

Line 12

New York State column: Multiply net gains (not less than zero) from sales of loans not secured by real property by a fraction, the numerator of which is the amount of gross proceeds from sales of loans not secured by real property to purchasers located within the state, and the denominator of which is the amount of gross proceeds from sales of such loans to purchasers located within and outside the state.

Everywhere column: Include the amount of net gains (not less than zero) from sales of loans not secured by real property within and outside the state.

Use Worksheet A.

Section 210-A.5(a)(2)(B): Federal, state, and municipal debt

Lines 13 through 18

New York State column: Do not include receipts in column A unless you have made the election to apportion qualified financial instrument receipts using the 8% fixed percentage method.

Everywhere column:

- For lines 13, 15, and 16, enter 100% of the applicable receipts regardless of if the 8% fixed percentage method election was made.

- For lines 17 and 18, if the 8% fixed percentage method election was made, and the qualified financial instrument box above line 13 is marked, enter 100% of the receipts constituting interest and net gains from sales of debt instruments issued by other states or their political subdivisions.

- Otherwise, enter 50% for lines 17 and 18.

Line 16

When netting gains against losses, only net the gains from federal, NYS, and NYS political subdivisions debt against the losses from federal, NYS, and NYS political subdivisions debt. Do not enter less than zero.

Line 18

When netting gains against losses, only net the gains from other states and their political subdivisions debt against the losses from other states and their political subdivisions debt. Do not enter less than zero.

Section 210-A.5(a)(2)(C): Asset-backed securities and other government agency debt

Line 19

Everywhere column: Enter 100% of the interest income from all:

- asset-backed securities issued by government agencies;

- other securities issued by government agencies, including but not limited to securities issued by the Government National Mortgage Association (GNMA), the Federal National Mortgage Association (FNMA), the Federal Home Loan Mortgage Corporation (FHLMC), or the Small Business Administration (SBA); and

- asset-backed securities issued by other entities.

New York State column: Enter 8% of the amount in the Everywhere column.

Line 20

Everywhere column: Enter the result (but not less than zero) of netting the gains and losses from all:

- sales of asset-backed securities or other securities issued by government agencies, including but not limited to securities issued by the Government National Mortgage Association (GNMA), the Federal National Mortgage Association (FNMA), the Federal Home Loan Mortgage Corporation (FHLMC), or the Small Business Administration (SBA); and

- sales of other asset-backed securities that are sold through a registered securities broker or dealer, or through a licensed exchange.

New York State column: Enter 8% of the amount in the Everywhere column.

Line 21

New York State column: Multiply net gains (not less than zero) from sales of other asset-backed securities not reported on line 20 by a fraction, the numerator of which is the amount of gross proceeds from such sales to purchasers located in the state, and the denominator of which is the amount of gross proceeds from such sales to purchasers located within and outside the state.

Everywhere column: Enter 100% of the amount of net gains (not less than zero) from sales of other asset-backed securities not reported on line 20.

Use Worksheet A.

Section 210-A.5(a)(2)(D): Corporate bonds

Line 22

New York State column:

- Enter interest from corporate bonds when the commercial domicile of the issuing corporation is in the state.

- If the 8% fixed percentage method election has been made (the box on line 8 is marked), and the qualified financial instrument box above line 22 is marked, enter 8% of the applicable receipts.

Line 23

Everywhere column: Enter the result (but not less than zero) of netting the gains and losses from the sales of all corporate bonds sold through a registered securities broker or dealer, or through a licensed exchange.

New York State column: Enter 8% of the amount in the Everywhere column.

Line 24

New York State column: Multiply net gains (not less than zero) from those sales of corporate bonds not reported on line 23 by a fraction, the numerator of which is the amount of gross proceeds from such sales to purchasers located within the state, and the denominator of which is the amount of gross proceeds from such sales to purchasers located within and outside the state.

Everywhere column: Enter the amount of net gains (not less than zero) from sales of corporate bonds to purchasers within and outside the state.

Use Worksheet A.

Section 210-A.5(a)(2)(E): Interest income from reverse repurchase and securities borrowing agreements

Line 25

New York State column: Enter 8% of net interest income (not less than zero) from reverse repurchase agreements and securities borrowing agreements.

For this calculation, net interest income is determined after the deduction of the amount of interest expense from the taxpayer’s repurchase agreements and securities lending transactions. This amount cannot be less than zero.

The amount of such interest expense is:

- the interest expense associated with the sum of the value of the taxpayer’s repurchase agreements where the taxpayer is the seller or borrower, plus

- the value of the taxpayer’s securities lending agreements where the taxpayer is the securities lender, provided:

- such sum is limited to the sum of the value of the taxpayer’s reverse repurchase agreements where the taxpayer is the purchaser or lender, plus

- the value of the taxpayer’s securities lending agreements where the taxpayer is the securities borrower.

Section 210-A.5(a)(2)(F): Interest income from federal funds

Line 26

Everywhere column: Enter 100% of the net interest from federal funds. In determining net interest from federal funds, deduct interest expense that is from federal funds. The resulting net interest cannot be less than zero.

New York State column: Enter 8% of the amount in the Everywhere column.

Section 210-A.5(a)(2)(I): Net income from sales of physical commodities

Line 27

New York State column: Multiply the net income from sales of physical commodities by a fraction:

- the numerator of which is:

- the amount of receipts from sales of physical commodities actually delivered to points within the state or,

- if there is no actual delivery of the physical commodity, the amount sold to purchasers located in the state, and

- the denominator of which is:

- the amount of receipts from all sales of physical commodities actually delivered to points within and outside the state or,

- if there is no actual delivery of the physical commodity, the amount sold to purchasers located both within and outside the state.

Net income (not less than zero) from sales of physical commodities is determined after the deduction of the cost to acquire or produce the physical commodities.

If you marked the box on line 8 to elect the 8% fixed percentage method, and you marked the qualified financial instrument box above line 27, enter 8% of the applicable receipts in the New York State column.

Everywhere column: Enter 100% of the net income (not less than zero) from sales of physical commodities.

Section 210-A.5(a)(2)(J): Marked to market net gains

Line 28

Report all marked to market net gains on this line for all financial instruments.

For the purposes of computing marked to market net gains for this line, marked to market means that a financial instrument is treated by the taxpayer as sold for its fair market value on the last business day of the taxpayer’s tax year, despite no actual sale having taken place, under IRC §475 or 1256.

The term marked to market gain or loss means the gain or loss recognized by the taxpayer under IRC § 475 or 1256 because the financial instrument is treated as sold for its fair market value on the last business day of the tax year.

Report all marked to market net gains on this line.

If you did elect the 8% fixed percentage method:

- use that method to source marked to market net gains for all financial instruments that are qualified financial instruments.

- use the customer-based sourcing rule below to source the marked to market net gains for those financial instruments that are not qualified financial instruments.

If you did not elect the 8% fixed percentage method, use the customer-based sourcing rule below to source all marked to market net gains for all financial instruments.