Tax professionals

Tax professional Resources

Assist your client online

Access your client's information

Learn about your responsibilities

Find what you're looking for

Important Information

The 2024 Tax Preparer Registration application is now available!

If you’re a New York State tax return preparer or facilitator, you must register annually with the Tax Department.

If you haven't completed the 2023 Registration Education Requirements yet, you’ll need to before you can register for 2024.

If you have trouble using or accessing SLMS to complete your education coursework, see SLMS troubleshooting guide.

Additional Tools

Plan Ahead

Pay your client's bill or notice

You can make a payment or request a payment plan for your client using one of our convenient online options.

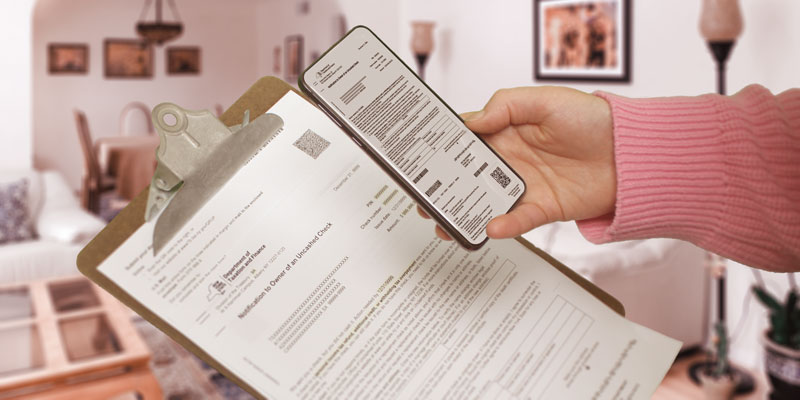

Learn what we're mailing

Did your client receive a letter, bill, notice, or check? Visit our new letter resource center for the latest information on what we're mailing.

Updated: