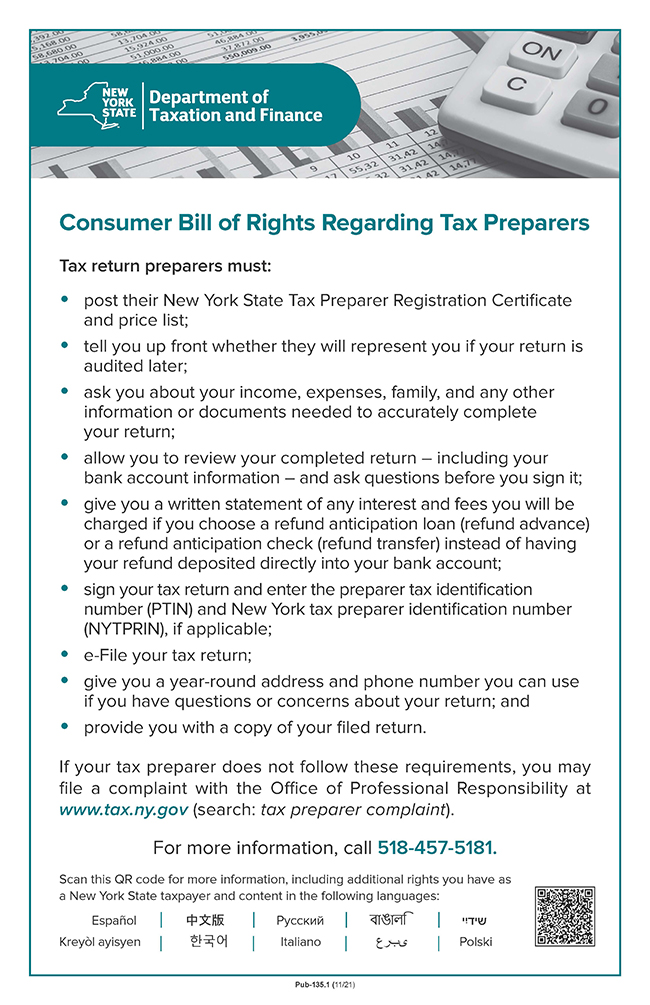

Consumer Bill of Rights Regarding Tax Preparers

Paid tax return preparers and facilitators must follow certain requirements under New York State law. While most tax return preparers and facilitators act within the law and treat their clients fairly, there are some that don’t.

The Tax Department’s Consumer Bill of Rights Regarding Tax Preparers describes your rights and contains important information about how to protect yourself when hiring a tax return preparer or facilitator.

Tax return preparers and facilitators must:

- post Publication 135.1, Consumer Bill of Rights Regarding Tax Preparers, and

- provide you with a free copy of Publication 135, Consumer Bill of Rights Regarding Tax Preparers, or the New York City Consumer Bill of Rights prior to any discussions.

Verify your tax return preparer’s or facilitator’s credentials

Certain tax return preparers and facilitators must register annually with the Tax Department and post copies of their current Certificate of Registrations.

To confirm your tax return preparer’s or facilitator’s credentials, see Verify your tax return preparer or facilitator.

Know your refund options

If you are paying tax preparation fees from your refund, your tax return preparer or facilitator may offer you one of the following refund options:

- refund anticipation loan (RAL), which is a high-interest loan, also known as a refund advance; or

- refund anticipation check (RAC), which is a bank product that allows tax preparation and other authorized fees to be deducted from your refund, also known as a refund transfer.

Your tax return preparer or facilitator must give you a written statement of any fees and interest charges.

Tax return preparers and facilitators cannot require you to use these products. You have the right to have your tax refund directly deposited into your bank account.

File a complaint

If your tax preparer does not comply with the requirements in the Consumer Bill of Rights Regarding Tax Preparers, you can file a complaint online.

Resources

- Publication 135, Consumer Bill of Rights Regarding Tax Preparers

- New York City Consumer Bill of Rights

- Income Tax Filing Resource Center

- Tax Tips for Individuals

- Posting requirements for tax return preparers and facilitators

- TSB-M-09(13)I Consumer Bill of Rights Regarding Tax Preparers