Filing a Final Sales Tax Return

Tax Bulletin ST-265 (TB-ST-265)

Printer-Friendly Version (PDF)

Issue Date: Updated June 13, 2014

Introduction

A business that is authorized to collect sales tax in New York State must report and remit any sales tax collected during each sales tax period in which it has a valid Certificate of Authority. A business is required to file annually, quarterly, or part-quarterly, depending on the amount of taxable sales or sales tax collected. Whenever a business closes or makes certain other changes, the business must file a final sales tax return.

This bulletin explains:

- when to file a final return,

- information on a final return,

- Web filing your final return, and

- filing a paper final return.

It is very important to continue to file your sales tax returns until you discontinue your business. This is true even if you owe no tax. If you discontinue business and do not file a final tax return, we may bill you for penalties for failing to file tax returns, which could lead to other collection activities. Following the rules set out in this bulletin will help you avoid this. For information about surrendering your Certificate of Authority, see Tax Bulletin Amending or Surrendering a Certificate of Authority (TB-ST-25).

When to file a final return

You must file a final return and surrender or destroy your Certificate of Authority if you:

- cease business operations;

- sell, transfer, or assign your business; or

- change the form of your business (for example, from a sole proprietorship to a corporation). You will need a new Certificate of Authority for the new business entity.

A final return must be filed within 20 days after you cease business operations or the sale, transfer, or change occurs. After we process your final return, we will inactivate your sales tax account. Your Certificate of Authority will no longer be valid. It is not necessary to return your Certificate of Authority to the Tax Department but your copy should be destroyed.

Information on a final return

Your final return must include the same information that you would include on a regular return. Report your sales, sales tax collected, and any use tax owed in the normal manner, and any special taxes or fees collected. Be sure to include any schedules that you would normally file with your return.

Web Filing the final return

If you have not already done so, you must register with Online Services to Web file your return. If the Web file return for the correct filing period is available at the time your final return is due, use the Web File return. When you Web file your final return, check the box indicating that it is a final return and enter your last day of doing business. Click on the box that most closely matches the reason you are filing a final return. If none of them are appropriate, click on the “other” box and enter a brief description of the reason you are filing a final return.

If you are changing your entity type (for example, you were a sole proprietor and you are now changing to a partnership or a corporation), you must file a final return as if you were selling or transferring your business. In addition, you must apply for a new Certificate of Authority at least 20 days before the change in business form takes place, and file Form AU-196.10, Notification of Sale, Transfer, or Assignment in Bulk, with the Tax Department at least 10 days before the change takes place. You may not transfer a sales tax Certificate of Authority from one business to another.

If you intend to sell your business or its assets, you must give the purchaser a copy of Form TP-153, Notice to Prospective Purchasers of a Business or Business Assets. You must also collect any sales tax due on the sale of any of your business assets and remit it with your final return. You must also provide information regarding the sale, including the date of sale, the sale price, and purchaser information.

If you are closing your New York business or if your out-of-state company will no longer conduct business in New York, follow this checklist to comply with the Tax Law.

If you normally Web file and the return for the final sales tax period of your business is not yet available, you must file a paper final return 20 days after you stop doing business and surrender or destroy your Certificate of Authority. You will need to make the changes to the paper final return described below under the heading Changing a paper sales tax return for use as a final return.

Filing a paper final return

The Tax Department doesn’t produce a separate paper form for use as a final return. If you need to file a final return before Web file is available for that period, you’ll need to modify the return appropriate for your filing status (annual, quarterly, or monthly (part-quarterly).

- Annual filers: use Form ST-101, New York State and Local Annual Sales and Use Tax Return.

- Quarterly filers: use Form ST-100, New York State and Local Quarterly Sales and Use Tax Return.

- Part-quarterly (monthly) filers:

- for any monthly period in which the business was still operating, use Form ST-809, New York State and Local Sales and Use Tax Part-Quarterly Return, and

- use Form ST-810, New York State and Local Quarterly Sales and Use Tax Return for Part-Quarterly Filers.

For example:

Annual filers. If you close your business on July 5:

- file a final Form ST-101 covering the period from the previous March 1 (the beginning of the annual sales tax period), through July 5 (due July 25).

Quarterly filers. If you close your business on July 5:

- file a final Form ST-100 covering the period June 1 (the beginning of the current sales tax quarter) through July 5 (due July 25).

Part-quarterly (monthly) filers. If you close your business on July 5, file all of the following:

- file Form ST-809 for the period June 1 through June 30 (due July 20); and

- file Form ST-809 for the period July 1 through July 5 (due July 25); and

- file Form ST-810 for the period June 1 through July 5 (due July 25).

If you are filing a paper return and using a prior-period return, be sure that the sales tax rates and reporting codes are correct for the current period. See Tax Bulletin Sales Tax Rate Publications (TB-ST-820).

Changing a paper sales tax return for use as a final return

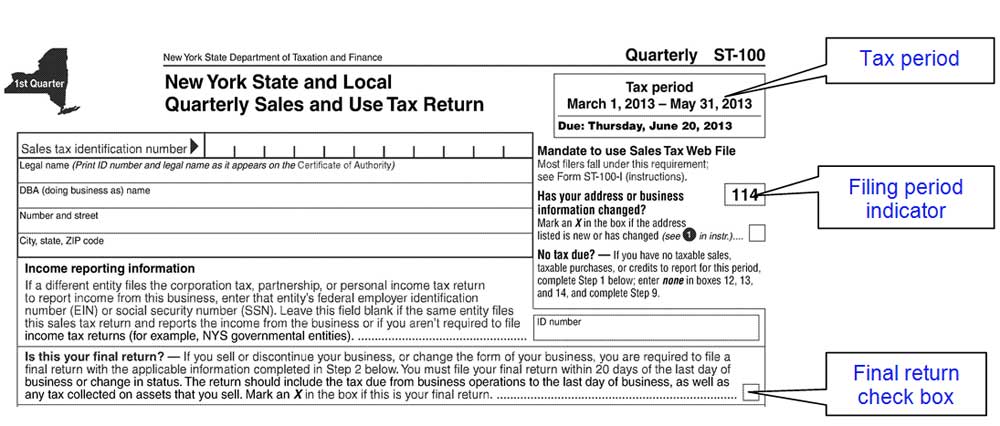

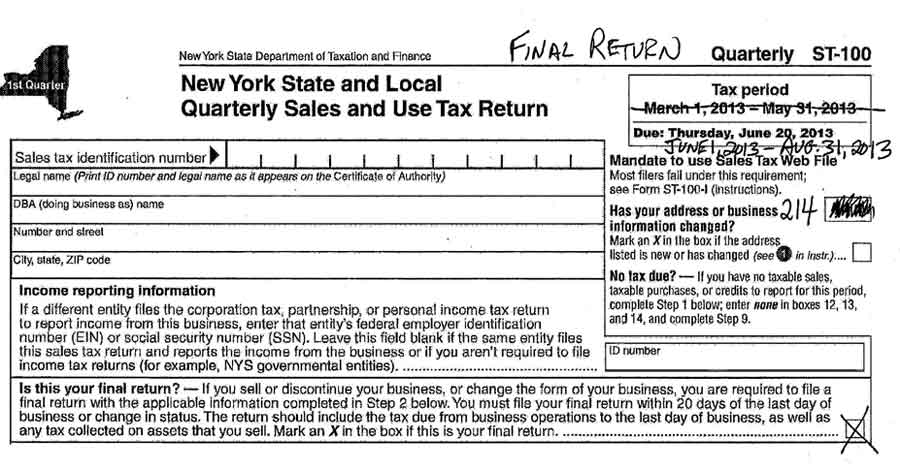

You may need to correct or alter two areas when filing a final return (see illustration below):

- tax period dates

- filing period indicator

Using the example above, a quarterly filer that ceased business on July 5, 2013, would need to alter Form ST-100 as follows:

- Cross out the tax period dates (in this case, March 1, 2013 - May 31, 2013.

- Completely black out the filing period indicator.

- Write in the correct filing period indicator (see Tax Bulletin Filing Period Indicators on Final Sales Tax Returns (TB-ST-270) for assistance).

- Write FINAL RETURN across the top of the return form.

- Check the box that says Final return.

The top of your final return should look something like this:

Note: A Tax Bulletin is an informational document designed to provide general guidance in simplified language on a topic of interest to taxpayers. It is accurate as of the date issued. However, taxpayers should be aware that subsequent changes in the Tax Law or its interpretation may affect the accuracy of a Tax Bulletin. The information provided in this document does not cover every situation and is not intended to replace the law or change its meaning.