Subscribe

Sign up to receive Tax Tips for Individuals.

For information about the most common refund statuses, including frequently asked questions, see Understanding your refund status.

See below if your refund status says the following: We processed your return and adjusted the refund amount that you claimed. You will receive correspondence explaining the adjustment.

If we made one or more adjustments to your personal income tax return:

You should compare your income tax return to the Explanation section of the notice to best understand the adjustment.

If you disagree with the adjustment, you can respond with documentation that supports what you claimed on your return.

The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. To ensure that you receive future communications in the Message Center of your Online Services Account Summary homepage, create your account now, before filing your next return.

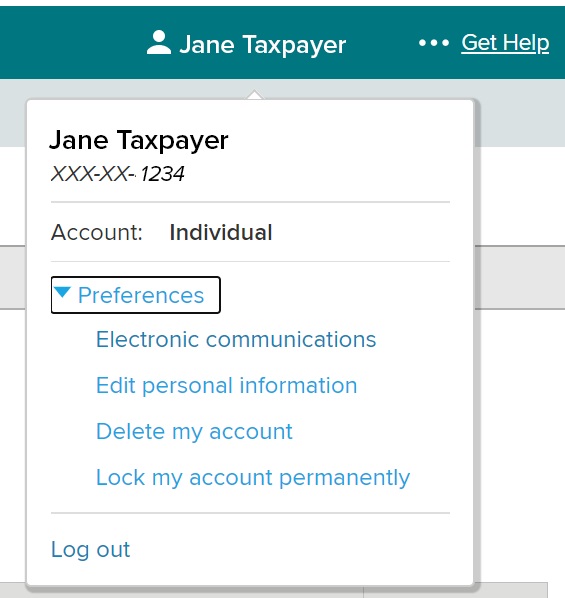

Once you've logged in to your Online Services account:

Sample image of Online Services screen

Dropdown "Preferences" displays available options: Electronic communications, Edit personal information, Delete my account and Lock my account permanently.

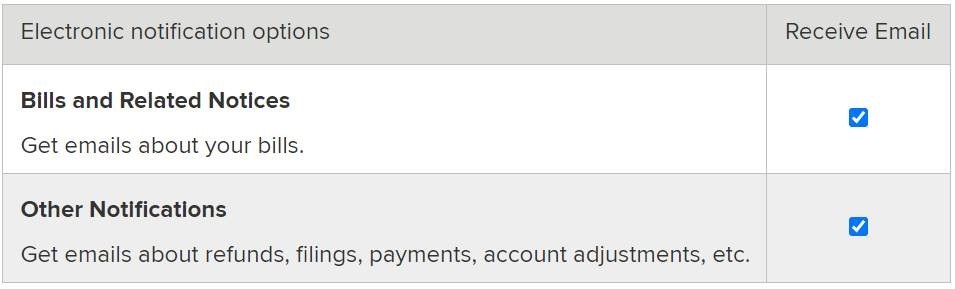

Electronic notification options

Bills and Related Notices-Get emails about your bills.

Other notifications-Get emails about refunds, filings, payments, account adjustments, etc.

Receive email

Sign up to receive Tax Tips for Individuals.

Did you receive a letter asking you to complete Form DTF-32, DTF-33, TD-210.2, TD-210.3, or TD-210.7?

To receive your new check sooner, use your mobile device to submit your form online!

Benefits include: